Your 70s are a golden decade of opportunity. You're probably mortgage-free, are no longer shackled to a corporate job, and have plenty of time to spend with grandchildren or even great-grandchildren. But with your newly found freedom comes responsibility. You may have been thinking about the legacy you will leave behind and ways to help your beneficiaries. You would be forgiven for thinking life insurance might be out of reach or unsuitable at your age.

There are still life insurance options available to you in your 70s that could provide the cover you need. There is no need to worry that your loved ones will struggle to cover the cost of your funeral or pay off a large inheritance tax bill. You have policy options that could support your spouse or wider family financially when you die. A life insurance policy could give you the peace of mind you need to enjoy this golden decade.

And while this type of insurance is not appropriate for everybody, it is worth informing yourself about your options and considering whether a policy makes sense for you and your family.

What types of life insurance are available to you in your 70s?

Your 70s are a crucial decade in which to consider life insurance. Many life insurance companies have a maximum age of 80 for issuing new policies. As such, your 70s are the last decade in which you will have various options available to you. After this point, your choices are severely limited.

So, what types of insurance policies are available to you in your 70s?

Over 50s life insurance

Over 50s life insurance is a specialised product that caters to seniors. It does not require medical underwriting, so, regardless of the specific type of policy you want, you will not have to:

- Answer any health questions

- Disclose your medical history, pre-existing conditions, or developing health issues

- Undergo a medical exam

You will, however, usually have to disclose whether you're a smoker or non-smoker, and some insurers will also ask general lifestyle questions.

Over 50s life insurance is a type of whole of life insurance. This means it lasts a lifetime as long as you keep up with your premium payments. Your loved ones will receive a set payout when you die, regardless of when this happens.

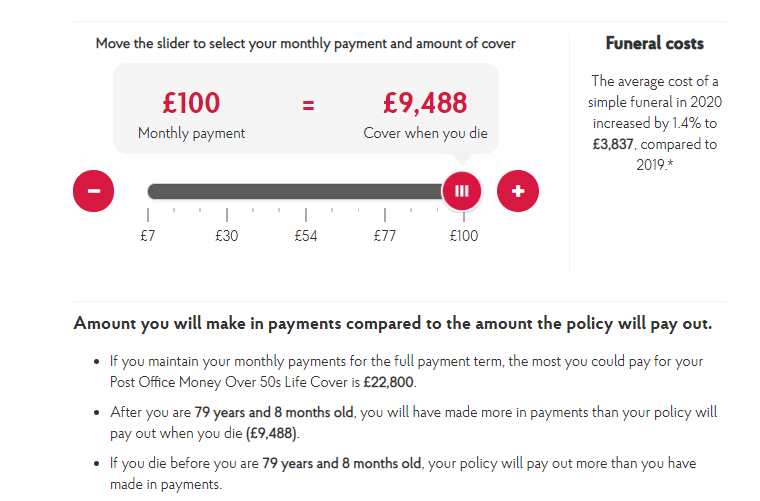

Because these policies are riskier for insurers, they can be more expensive than term life insurance and offer a limited payout. For instance, the Post Office offers over 50s life insurance capped at a cash value of around �£10,000. You must be 80 or below when you take out the policy for it to apply.

An over 50s life insurance policy works well for people interested in covering their funeral costs or perhaps helping their families settle an inheritance tax bill. However, insurers rely on you outliving your policy to make money. So, you may find that you pay more into your policy than the eventual payout.

The Post Office insurance quote tool illustrates this. For example, a 71-year-old female wishing to take out the maximum cover available to her (£9,488) would need to pay £100 per month in premiums. But if she lives beyond 79 years and 8 months, she will have spent more than her policy would pay out when she dies.

Over 50s life insurance could make sense if you know you have a critical illness or terminal illness and have shortened life expectancy. Some insurers even offer critical and terminal illness cover that pays out upon diagnosis, so you could get your payout to sort your affairs and pay all your final expenses yourself.

However, if you are in good health and expect to live beyond 80, you should consider other options. You can find out more about over 50s life insurance here.

Funeral cover

A funeral plan is not a life insurance policy. Still, many insurance providers offer it as an alternative for those seeking to cover the cost of a funeral when they die. You might sometimes see these plans marketed as burial insurance.

This type of cover allows you to lock in today's funeral prices and plan your send-off. You must pay off the full amount, either as a lump sum or by spreading the cost.

Providers like Aviva offer plans ranging from £3,000 to £4,000 for a funeral plan that could be as comprehensive as you wish. So not only do you lock in today's prices, but unlike with an over 50s life insurance plan, you do not have to worry about paying more in than you will receive.

This is a good option if you are purely interested in covering your funeral costs and illustrates why life insurance might not always meet your needs.

Term life insurance

Your options will be more limited in your 70s, but you will still have term life insurance choices available to you. Insurers will often offer shorter terms with higher premiums once you turn 70, with many insurers not providing this cover beyond 90.

Term life insurance policies work great if you are looking for a high payout for a specified period. It is ideal if you have dependents you're worried about or debt you don't want to leave behind when you die.

This type of insurance is usually taken out to cover mortgage payments or provide for children or grandchildren who might still depend on you. The idea is that your mortgage will be paid off eventually, and your children and grandchildren will be financially independent once they reach a certain age. After this stage, you will no longer require insurance.

Most insurers won't insure you after the age of 90. This means that your maximum life insurance term at the age of 70 would be about 20 years, depending on your insurer. So if you wanted a payout of £100,000 for a 20-year term, you could expect to pay upwards of £170 per month. We investigated life insurance premiums by age here if you are interested in seeing how premiums change as you age.

While £170 per month will be a prohibitive amount for many pensioners, you could consider a shorter term or a lower payout to reduce your premium. Depending on your needs, you could lower your premium by also taking out decreasing term life insurance.

Level term vs decreasing term life insurance

Level term and decreasing term life insurance policies guarantee a payout if you die while your policy is still active or within the specified period. However, the policies differ in how they are paid out.

A decreasing term policy's value falls as the term progresses. It is an appropriate choice for someone wishing to cover a loan, like a mortgage. As you pay off your loan and the amount gets smaller, so does the life insurance payout you might receive if you were to die prematurely. The payout will still cover your outstanding loan, but while you might receive £100,000 at the beginning of your policy, this amount will dwindle as your policy progresses until it is worth nothing at the end of the term.

A decreasing term policy is a great way to keep costs low if you are worried about prohibitive premiums.

A level term policy offers a set payout regardless of when you die as long as the policy is active. So, for example, if you are insured for £100,000, your loved ones will receive £100,000 even if you die near the end of your policy. This choice is appropriate for those wishing to provide an inheritance or those with an interest-only mortgage.

Do you need life insurance in your 70s?

By the time you turn 70, you might find yourself without any dependents or outstanding debts. If your mortgage is paid and your children are financially independent, a life insurance policy might be an unnecessary expense.

However, there are a few reasons why you might consider taking out a policy. These include:

- Covering an inheritance tax bill

- Providing your loved ones with an inheritance

- Paying for your own funeral

- Paying off your mortgage

- Providing for any dependents

How to keep life insurance premiums low in your 70s

If you decide that you need life insurance in your 70s, there are several ways to keep premiums low depending on your needs.

- You could speak to an insurance broker who will find the best deals for your circumstances.

- You could opt for a decreasing term policy that will cover any outstanding debt.

- You could choose a shorter term or a lower payout.

- If funeral cover is all you are interested in, you could opt for a pre-paid funeral plan instead of a life insurance policy and lock in the price of your funeral.

Finding the best life insurance for your needs

Your 70s are the last decade in which you will have various life insurance options available to you. You will still be able to get life insurance in your 80s, but your options will be greatly limited with prohibitive premiums to boot.

If you believe that you could benefit from a life insurance product, now is a crucial time to start your research and weigh up your options. The right policy could give you the peace of mind that your loved ones won't have to pay for an expensive funeral or deal with outstanding debts.

Depending on your needs and budget, there are term life insurance options available to you and over 50s life insurance that does not require medical underwriting. You could simply opt for a funeral plan if life insurance covers do not suit your needs.

Bear in mind that insurance premiums at this age could cost you more than any potential payout. If you are unsure about the type of insurance you need, you could speak to an insurance broker who will be able to find you the best deal for your circumstances.

Ensure you are not over-insuring yourself if you do not have outstanding debts and the people around you are financially independent. Insurance premiums could be an unnecessary expense that could be better spent elsewhere.

Whether you take out life insurance is a personal choice guided by several financial and personal factors. A policy could offer you peace of mind, which in itself could be enough reason to take the plunge.