While finding a life insurance policy that meets your needs in your 80s is possible, researching and shopping around is essential if you wish to buy a policy that doesn't break the bank.

The best life insurance policy for you will give you peace of mind and ensure that your loved ones are taken care of when you die. The type of policy you select will depend on your individual circumstances, including cover needs and budget.

There are still options available to you. Senior life insurance policies may have later cutoff ages than other life insurance policies. Funeral cover to pay for your funeral costs could be an affordable alternative to some life insurance policies. It is essential to shop around and obtain multiple life insurance quotes from different insurance providers before selecting a policy.

And before you purchase a policy, you should think carefully about why you want to take out life insurance and whether more suitable choices are available to you.

Do you really need life insurance in your 80s?

Before buying life insurance, you should consider whether it's right for you. While we all want peace of mind in our later years, a life insurance policy could end up costing you more in monthly premiums than any potential payout to your beneficiaries.

Before taking out a product, ask yourself why you want a life insurance policy. Is it to pay off outstanding debts, provide an inheritance, or cover your funeral expenses? It could also be worth speaking to an insurance broker who will be able to advise you on the best life insurance policies available to you. They will usually also be able to get you the best price. If you aren't sure what to ask your broker, we have a great guide to help you out here.

What are the benefits of life insurance for seniors over 80?

We all want to make sure our loved ones are looked after when we die. Life insurance cover could pay off outstanding debts or provide a small inheritance for your beneficiaries.

There are also inheritance tax benefits to consider.

Inheritance tax benefits

A life insurance payout is exempt from income tax or capital gains tax. For estates valued below 325,000, no inheritance tax will apply. But anything valued above £325,000 will incur a 40% tax that your beneficiaries will need to pay.

Life insurance policies allow you to get around this by writing your life insurance policy into a trust. If you do this, the money goes directly to your beneficiaries and is not considered part of your estate. Alternatively, some policyholders choose to take out a life insurance plan to help their loved ones cover an inheritance tax bill.

If you would like to learn more about using your life insurance plan to pay your inheritance tax, we have an article discussing this here.

What types of life insurance policies are available to over 80s?

While life insurance options in your 80s are limited and come with significant monthly premiums, some insurance providers will still cater to your needs if you have the budget.

Before purchasing a life insurance product, you may wish to consider funeral cover. However, if funeral cover does not meet your needs, you could look at over 50s life insurance or term life insurance policies.

Funeral cover

Strictly speaking, funeral plans are not life insurance policies. But the two are often lumped together as they offer very similar benefits and outcomes in terms of functionality.

Funeral plans are designed to pay your funeral expenses. When you buy your funeral plan, you may be given the option to 'lock-in' the cost of a funeral. This means your funeral plan won't be affected by inflation, and you will pay today's prices for a funeral that might not happen for many years.

There are several options to explore if you are thinking about using this type of plan to cover the cost of your funeral. Some plans payout in the same way as life insurance cover. Your loved ones receive a lump sum when you die, which can then be used to pay for any funeral expenses. Other plans allow you to pay for your own funeral in instalments. But these plans only pay out if you have paid off your funeral cover in full before you die. If you do not, your beneficiaries could be asked to settle any outstanding expenses.

The way these policies work will change in 2022 when the Financial Conduct Authority (FCA) takes over regulation from the Funeral Planning Authority (FPA). Funeral providers will then need to offer a funeral regardless of whether you've paid off your plan before you died.

You can expect to pay around £3,500 if you opt for funeral cover, but costs vary based on the package you select. Cremations are usually cheaper than burials, for example. If you choose a more expensive package, you can expect a more elaborate service from the funeral director. If you want to learn more about this type of cover, we have a dedicated guide here.

Senior life insurance

Senior life insurance, also known as over 50s life insurance, is a whole of life insurance policy that guarantees a payout to your beneficiaries as long as you have paid your monthly premiums.

The benefits of this type of policy include:

- A guaranteed payout as long as you pay your premiums in full

- No medical exam

- No health questions about any health issues

- No need to disclose your medical history or any pre-existing health conditions

- No set term; your beneficiaries will receive a payout regardless of when you die

Some of the drawbacks of this type of life insurance include strict age limits. Many senior life insurance providers have an age limit of about 80. The older you get, the more you have to pay in premiums. In many cases, you might end up paying more in premiums than any potential payout your loved ones might benefit from.

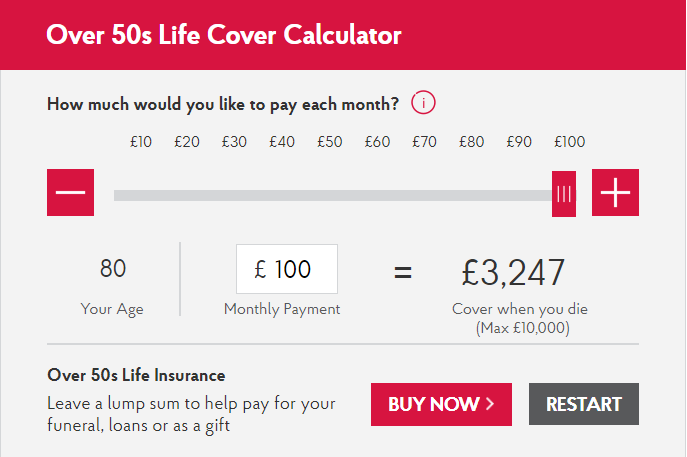

For example, if you are an 80-year-old looking to take out a senior life insurance policy with the Post Office, you would need to pay £100 per month so that your beneficiaries could receive a lump sum of £3,247 when you die. This is the maximum amount the Post Office offers for an 80-year-old taking out insurance for the first time.

This works out to £1200 per year in premiums. So if you expect to live more than 2.7 years after taking out your policy, you will end up paying more in premiums than your beneficiaries will receive in payouts when you die.

The older you get, the less likely you are to benefit from a senior life insurance policy as a policyholder. However, it is still worth shopping around to see what insurance providers can offer. But make sure you work out just how much you will be paying in premiums if you are in good health and expect to live a long life. The average life expectancy in the UK is around 79 for males and 83 for females.

Term life insurance

Most life insurance companies have upper age limits for term life insurance products. Very few mainstream companies have cutoffs later than 80. Many opt to set their age limit at 75 or 80.

There are still options available to you if you are seeking term life insurance policies. Some of the benefits include:

- Cheaper than whole of life insurance

- Higher payouts if you die within the insurance term

- The possibility to opt for level term or decreasing term policies depending on your needs

While a level term policy offers a set payout if you die before the end of your policy term, the value of a decreasing term policy usually falls as the policy term progresses. Therefore, this type of cover works best to help pay off outstanding debt, such as a mortgage. You can learn more about the difference between level and decreasing term cover here.

Term life insurance policies could still be a realistic option in your 80s. We created a fictitious 85-year-old woman, Jane Doe, and requested life insurance quotes for a 5-year term via a comparison website. The payout we requested was £10,000.

While only one insurance provider came up with a quote, we were quoted around £55 per month for the policy we requested. This premium could be affordable if you're seeking life insurance with a higher payout.

However, you will be limited regarding the term you could be insured for. Many comparison sites have a cutoff age of 90, with some opting for even lower age limits.

Still, if you only want an insurance policy for a specific period, you could save yourself high monthly payments and opt for a higher payout by choosing a term life insurance product over a whole-of-life insurance policy.

Life insurance policies for over 80s: Are they the right choice?

The best life insurance policy for you is one that gives you the peace of mind that your loved ones will be taken care of when you die. It won't break the bank, and it will meet your needs.

You might find that you don't need a formal life insurance product at all. For example, if you have savings that will provide for your loved ones when you pass on, you may wish to spare yourself the life insurance cost altogether. Also, funeral cover that pays for your funeral expenses could be an affordable option that meets your needs.

If you do opt for a life insurance policy, there are options available to you that are relatively affordable. Just make sure that you will not end up paying more in monthly premiums than any potential payout!