At first glance, many people may find it difficult to see why insurance companies would treat older homeowners any different. They are insuring their home against an array of potential dangers, or in some cases, they may be renting property or even be a landlord themselves. Before we look at the specific benefits of home insurance for older people, we will look at the different types of home insurance available today.

On a side note, as an existing customer, it can also be worth negotiating both home and car insurance with the same provider. You might be surprised at what you can save by taking out various insurance products with the same provider! Furthermore, you could even enjoy reductions on any life insurance or travel insurance policies you take out, too!

Different types of home insurance

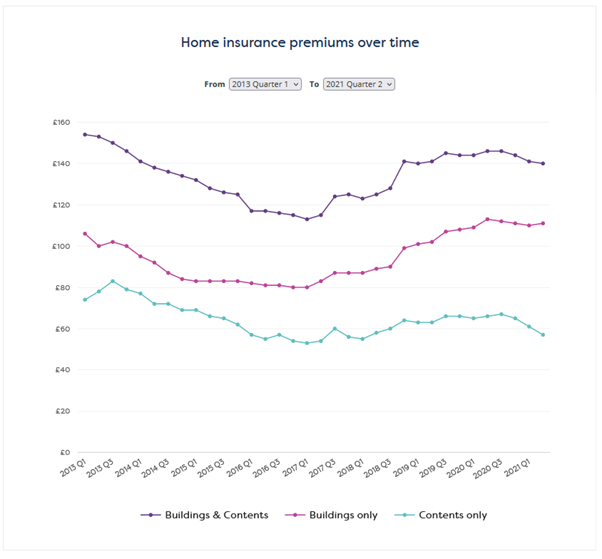

The majority of people will be familiar with buildings insurance and contents insurance and offers which combine the two. However, before looking at various types of home insurance in more detail, the following graph shows an interesting trend since 2013.

There has been a reduction in the cost of contents insurance and an increase in buildings insurance. The net impact for combined buildings and contents insurance has been downwards due to the fall in contents insurance premiums. There are numerous issues to consider with these two different types of insurance that we will cover in a moment.

Source: Moneysupermarket.com

Buildings insurance

Buildings insurance is precisely what you would expect. In basic terms, this is a policy that protects the bricks and mortar of your home and will generally cover the cost of repair or rebuilding your house in the event of damage. Some of the more common issues covered by buildings insurance include:

- Storms and lightning

- Fire, smoke and explosions

- Flood and escape of water

- Natural disasters

- Subsidence

- Malicious persons and rioting

- Collision by vehicle and animals

- Collapse of aerials and satellite dishes

- Falling trees

In addition, some insurance companies provide the same level of cover for outbuildings, too.

As you will see from the above graph, buildings insurance premiums have increased since 2013 and are expected to remain relatively strong. There are two main reasons why buildings insurance has not fallen in line with contents insurance:

- Reduced competition in the sector

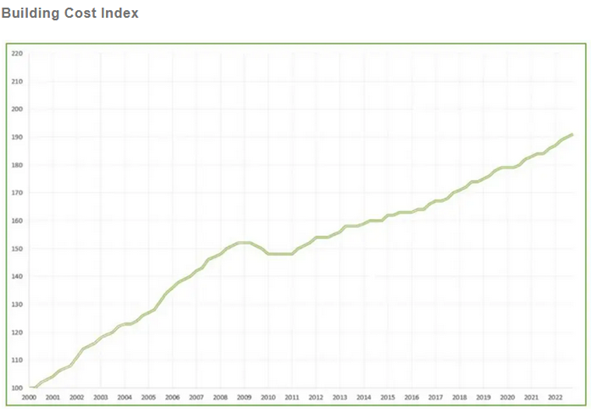

- Increase in the Building Cost Information Service Rebuild Index

Due to the often complex nature of buildings insurance and the increasing frequency of natural disasters and climate-related issues, many insurance providers will pass on their liability via reinsurance contracts. This approach helps them protect themselves against significant losses as a consequence of damage to a building.

When it comes to the actual cost of rebuilding the property, insurance companies use the Building Cost Information Service Rebuild Index. This tool allows them to keep track of the cost of repairing and rebuilding properties. This index includes the cost of labour and materials and is likely to remain relatively strong.

Source: https://deacon.co.uk/2020/09/07/building-insurance-premium-increases-explained/

Many insurance companies will combine buildings insurance and contents insurance which is often more palatable with a downward trend.

Contents insurance

While buildings insurance cover has been impacted negatively due to the Covid-19 pandemic, contents insurance is very different. As the name suggests, contents insurance covers the stuff inside a property, but not the property itself. Some policies may even cover you for things like losing your credit card outside of the home, but your card provider should take care of this anyway. During the pandemic, the cost of contents insurance in the UK fell due to several reasons:

- People spent more time at home, meaning less chance of burglaries

- Increased competition in the insurance market

- Greater accessibility via the internet

- Fewer claims

In contrast, there has been a negative impact to spending more time at home during lockdowns - it has increased the chances of accidental damage around the house. It will be interesting to see how insurance premiums react in future, with more people expected to work from home.

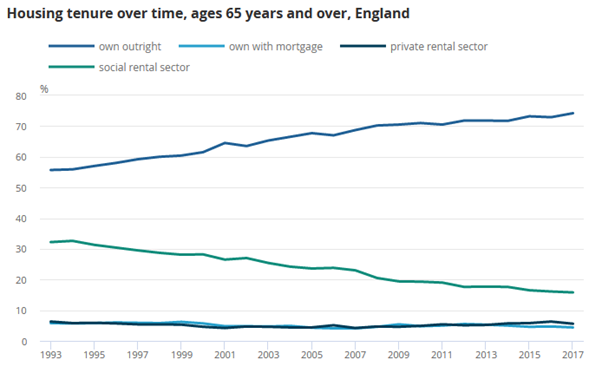

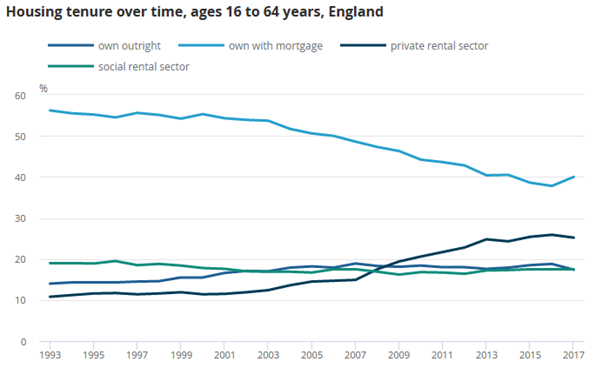

As you see from the following graphs, homeownership amongst older people has been on an upward trend since the 1990s. This is because many of these homeowners have lived through a highly prosperous period for the UK property market. In comparison, the number of people under 65 who own their homes has fallen.

Source: ONS

Source: ONS

Landlord insurance

Many older homeowners have used their pension assets and equity in their homes to acquire buy-to-let properties in recent years. While the government has increased the cost of running a buy-to-let, there are still some long-term benefits, such as property price appreciation and regular income. Consequently, landlord insurance may well be a consideration for some homeowners. There are numerous elements you can add on to this type of insurance. These optional extras can include any of the following:

- Contents insurance (excluding tenant belongings)

- Buildings cover

- Home contents

- Personal belongings

- Loss of rent

- Accidental damage cover

- Fire cover

- Water damage

- Tenant damage

- Tenant injury

- Home emergency cover

- Eviction costs

- Boiler breakdown

- Malicious damage

- Plumbing issues

- Rebuild costs

- Rent arrears

If you have a buy-to-let mortgage, then having landlord insurance will often be a requirement of your agreement, but at the very least, you'll enjoy peace of mind that your investment and asset is safe.

When looking at landlord insurance, you need to take a broader perspective as a means of maintaining the long-term value of what can be an expensive asset.

Tenant insurance

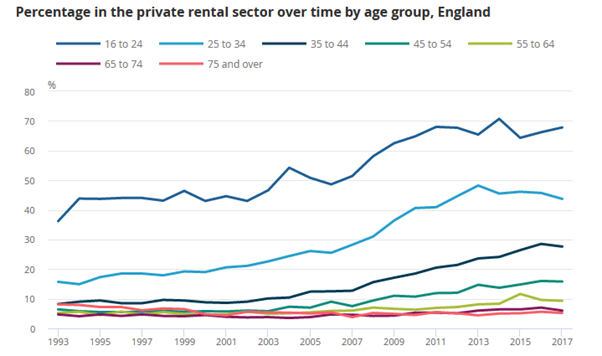

As you can see from the following graph, the number of people over 65 in private rental accommodation has remained relatively flat for some years. While more people in their 40s, 50s, and early 60s now rent, they're still less likely to do so than younger generations. That said,tenant insurance will still be a requirement for older people living in rented accommodation.

Source: ONS

There are many issues to consider with regards to tenant insurance which tends to cover the following:

- Theft

- Fire

- Burst pipes and water leaks

- Storms

- Flooding

- Cost of alternative accommodation

On the flip side, it is perhaps just as important to recognise what is not covered by standard tenant insurance:

- General wear and tear

- Theft and unforced entry

- High-value items

- Possessions outside the home

- Business contents

Unfortunately, many tenants automatically assume they are covered by the landlord's insurance, which is not generally the case.

High-value home insurance

A high-value home insurance policy is split between buildings insurance and contents insurance. It relates to properties that would cost more than £500,000 to rebuild and contain high-value items such as fine art, antiques and jewellery.

Why does traditional contents insurance not cover these items?

With standard contents policies, you tend to find a maximum value on any single item of personal belongings. Consequently, traditional contents insurance may not cover their market value if you have expensive jewellery, artwork or antiques. Therefore, a failure to consider high-value home insurance can prove costly if expensive items are damaged or stolen!

Holiday home insurance

Those older homeowners who have benefited from the property boom have sometimes invested in a holiday home. While the concept of insuring your holiday home is the same as your regular home, this will require specialist insurance. The main difference is that standard home insurance will not cover your property if it is unoccupied for more than 30 days. Holiday home insurance tends to be valid even if the property is left vacant for up to 60 days at a time. Check the small print!

Unoccupied home insurance

Unoccupied home insurance tends to be relevant for those who have inherited properties but already have their own home. The details of this type of policy will vary, and you will need to negotiate because, as a rule of thumb, insurance companies do not like properties vacant for more than 30 days at a time. The more obvious risks from an extended period of vacancy are vandalism, fire damage and flood damage. Left to fester, this could result in significant damage!

Is home insurance cheaper for over 50s?

At first glance, there is perhaps little reason to think that home insurance quotes might be cheaper for over 50s. However, GoCompare recently published an interesting article. They compared home insurance quotes for those aged between 50 and 64 and those in the 35 to 49-year-old bracket. The summary is as follows:

- £189 per annum - Average home insurance cost for those aged between 35 and 49

- £170 per annum - Average home insurance costs for those aged between 50 and 64

- The difference, circa 10%

This then prompts the question, why is home insurance cheaper for over 50s and over 60s?

Let us throw some light on the reasons:

- Less likely to make a claim

- Any claims tend to be smaller compared to younger homeowners

- More security conscious

- Tend to be financially secure

- More knowledgeable on home maintenance

- Years of experience arranging home insurance

- More honest about valid claims

- Spend more time at home, reducing the potential for theft and burglary

When your home insurance policy is up for renewal, you may find it productive to shop around. There are specialists in the over 50s home insurance market, which include:

- RIAS

- Saga

- Age Co

It is also essential to recognise that there is a degree of flexibility on home insurance policies. These can be moulded to suit your scenario.

The heavy price of underinsurance

Over the years, we may accumulate items that increase in value. Consequently, when looking at contents insurance, you mustn't be underinsured. Most home insurance providers will have exclusions and an upper limit, which will vary, on individual items included in their contents insurance. For example, if you have artwork, antiques or other precious personal belongings, you may not be covered for their total market value. Make sure you read your insurance policy documents!

Many providers will cover high-value items, but you'll need to make sure you have full details of what they are and their worth so you can add them to your policy.

Keeping up with buildings insurance

High-value home insurance is appropriate for properties that would cost more than £500,000 to rebuild. Many older homeowners will have held their properties for decades and may well have seen the value increase above the threshold. While traditional contents insurance and buildings insurance will cover you to a certain degree, it is vital to check that you are fully protected. Take nothing for granted, and make sure you check out several insurance providers!

Home insurance for older people is a competitive market

Home insurance cover for over 50s, over 60s, and over 70s tends to be cheaper than for younger homeowners. Whatever type of insurance you are looking at, the principle is the same; the risk/reward ratio determines the level of premiums. Consequently, with older homeowners seen as less risky, there is significant competition in this area.

The internet has also expanded the reach of general and specialist home insurance companies. Even though a full review of all insurance options is only a key click away, many of us automatically renew with our existing insurers. Therefore, next time your home insurance is up for renewal, you may find more competitive rates available from other insurance companies. Shop about!