The idea of releasing equity in your property is relatively straightforward. Still, there are several issues to be aware of in practice. These issues become a little more challenging for the over 50s, but this has prompted the creation of new equity release products and new markets. As some of the options are a little more complicated than a traditional remortgage, it is essential to speak with an equity release adviser as soon as possible.

What is equity release?

In simple terms, equity release is a means of retaining ownership of your home but releasing some of your home's value - the equity - that has built up over the years. Traditionally, we would do this by remortgaging based on the value of our homes. However, this is not always possible for over 50s who are possibly experiencing a reduction in their income. There is now the option of a lifetime mortgage or a home reversion scheme whereby capital is raised differently but not repaid until you die or move into full-time care.

There are many equity release calculators available online that will indicate what may be available. However, equity release deals will still be subject to your financial status. Therefore, you must approach an equity release provider for a personalised illustration and quote.

Popular reasons for equity release

Many people view home equity as underperforming funds because, at best, it will follow house prices. Consequently, as funds become a little tighter, releasing an element of equity from your home can be tempting. There are several popular reasons for considering equity release.

Garden and home improvements

A recent survey confirmed that 30% of those looking to release equity from their property did so to fund home and garden improvements. In theory, an investment in home and garden improvements should add value to the property in the longer term. However, it is crucial to take advice from local estate agents. This is because many areas of the UK have a property "price ceiling", which effectively caps house prices. Consequently, there might be occasions where the cost of your home improvements doesn't reflect in the property's value.

New property purchase

As a "baby boomer" born between 1946 and 1964, have you benefited from a massive increase in property prices? If so, and you're approaching, or already in retirement, you could potentially release equity from your house and use the funds to acquire another property or holiday home. While there are risks with further property investment, releasing equity can create a helpful income stream with the potential for long-term capital appreciation.

When acquiring additional properties, it may be helpful to take advice regarding potential inheritance tax issues further down the line.

Release tax-free cash to pay off your mortgage or other debts

It may seem a little bizarre to release equity in your property to pay off your mortgage. How does that work? With a lifetime mortgage, you can remortgage part of your property. The interest is rolled up and repaid to the lender, together with the mortgage capital, when you die or move into long-term care.

Many consider equity release to pay off additional debt such as credit cards or personal loans. While the idea of tidying up your finances can reduce long-term financial pressure, it is even more effective with high-interest finance. For example, let's say you have credit card debts with an interest rate of over 20% per year. By releasing equity, which will only track property prices at best, you're effectively saving 20% per annum less the remortgaging or lifetime mortgage cost. Potentially an advantageous way to use the equity in your property!

Increase disposable income

The only time that equity would be released is death for many people. In many ways, those who have saved up to pay for their home, creating significant equity, will never feel the benefit. However, things are changing!

Most over 50s will experience a degree of reduced income from employment. While some of this will be replaced by pension income, overall, it is not uncommon to experience a decline in disposable income. Therefore, releasing equity in your property, as a lump sum or bit by bit, can help to shore up your disposable income and improve your standard of living. This subject is even more crucial when considering the recent increase in energy costs which will significantly impact many household budgets.

Helping family members

Inheritance tax planning should be integral to your annual financial review, especially as you move towards retirement and beyond. In many ways, the inheritance system is flawed; beneficiaries receive funds after your death which may have been more helpful in their early years. In addition, many of those approaching retirement may be looking at assisting with further education costs for children and great-grandchildren.

This can be an incredibly complex area of taxation because there are various "gifts" you can make to loved ones without incurring tax. Alternatively, significant payments to family members may attract inheritance tax further down the line. So don't forget to take advice!

One-off purchases

As you approach retirement age, you may be eligible for a significant tax-free lump sum from your pension scheme. After years of working and saving into your pension, you may want to treat yourself to a one-off purchase such as a new car or that dream holiday. There are no tax complications with this option. So withdraw your tax refunds and spend them!

Are there any age limits on equity release?

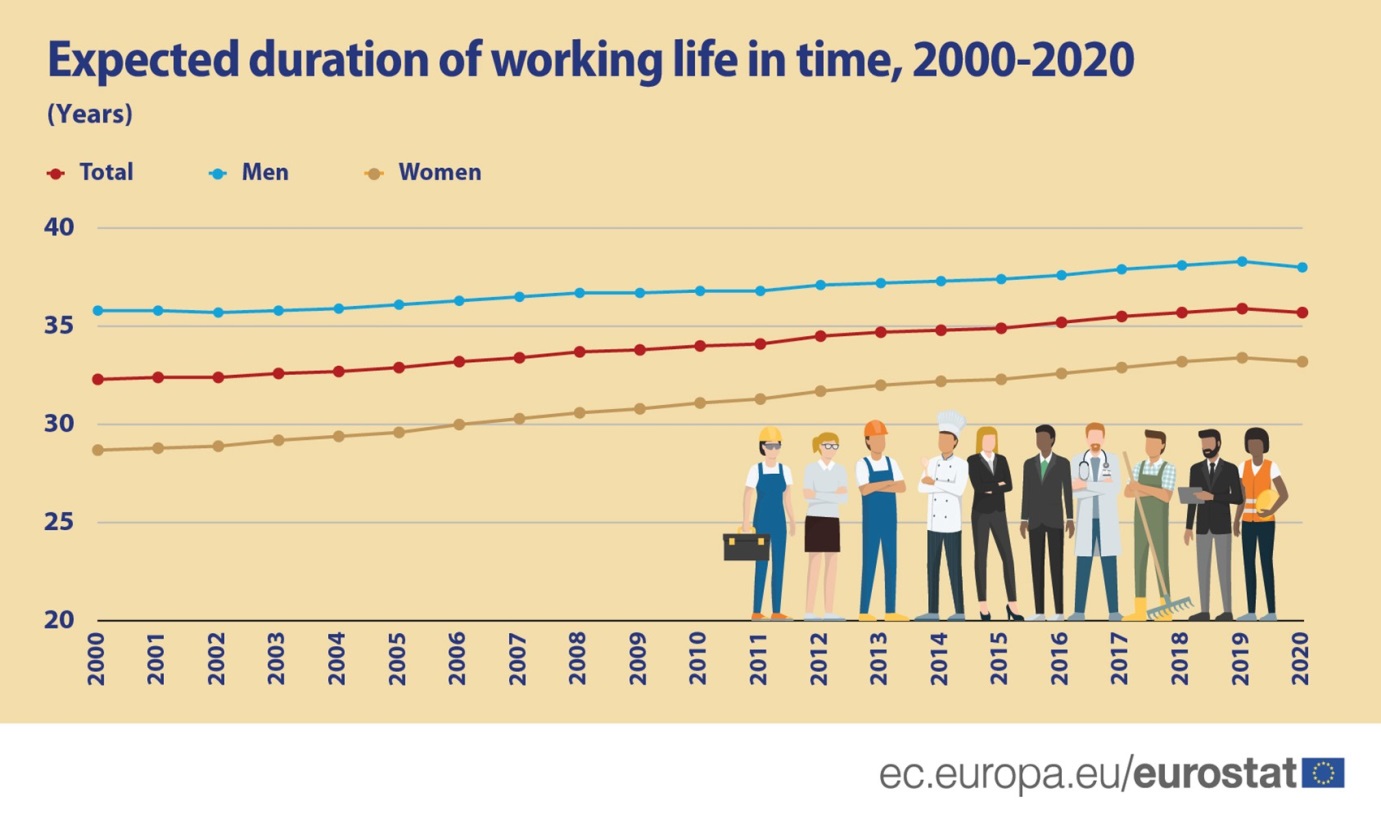

Other than in 2019 and 2020, there has been a gradual increase in the duration of our working life. This trend will likely take another upward surge due to changes to the UK pension age. When you also consider the ever-growing cost of living, many over 50s will be working full-time to maintain, let alone enhance, their standard of living.

Source: Europa.EU

As a consequence of this upward trend in the duration of our working lives, more over 50s will have employment income streams and potentially pensions and other investment income. For many, employment income will reduce with age. However, a traditional remortgage could still be available for those in their 50s, 60s, 70s and 80s. When looking at lifetime mortgages and home reversion schemes, there is a minimum age limit of 55.

It is illegal to discriminate against anyone on the grounds of age alone. So a traditional remortgage should be based on your financial situation and not your age. When it comes to a lifetime mortgage, the older you are, the more equity you can release because of the reduced impact of interest on interest. A home reversion scheme has no age limit as you sell part of your property to an investor.

The ongoing strength of the "grey pound" has created an array of new services and financial tools for over 50s. The UK is an ageing population; working lives are being extended, and traditional age cut-off points have been redrawn. So, amidst a sea of options and opportunities, you must take financial advice at the earliest opportunity. There is much to consider!

How much can you raise through equity release?

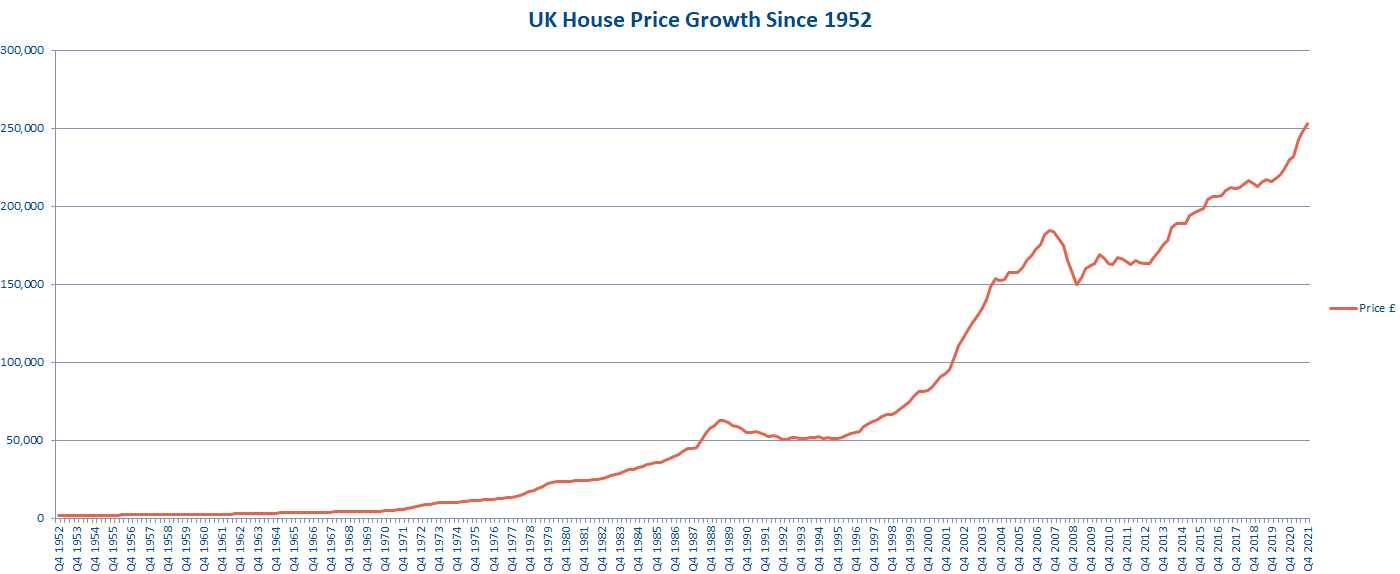

The precise level of equity you can release from your property will vary according to your financial situation. With this in mind, it is crucial to appreciate the vast increase in house prices over the years. The following graph shows the Nationwide House Price Index going back to 1952. The average home was valued at £1,891, but if we fast forward to the end of 2021, the average value was £253,113. It is safe to say that the "baby boomers" have done well but what of other age groups?

Source: Nationwide House Price Index

Assuming that the average mortgage duration is 25 years, those who acquired their home before 1997 may have paid off their mortgage. In reality, they may have remortgaged and moved home numerous times, often building up equity. The average house price in the UK at the end of 1996 was £55,159. Compare this to the price at the end of 2021 (£253,113), which equates to house price growth of 350%.

Looking at the loan to value (LTV) ratio, a traditional mortgage could be up to 80% and a lifetime mortgage between 45% and 58%. There is no formal limit for a home reversion scheme.

Different types of equity release

We will now look at equity release mortgage options for those over 50. Traditionally, remortgaging is the popular route to take. However, while you may be eligible for such a product, you might find traditional mortgage options unaffordable. The good news is there are many other options for those closing in on retirement. Indeed, lifetime mortgages and home reversion schemes are structured explicitly for over 50s. So what are the alternatives?

Remortgage

Unfortunately, if an individual or a couple is experiencing a reduction in their income in later life, this will impact their ability to refinance an existing mortgage. It will reduce the LTV ratio, making mortgages more unaffordable. As we touched on above, due to changing working life trends and a greater appreciation of borrowers over 50, there are more significant opportunities today than ever. However, each case is different!

Some people working later in life may maintain a relatively high income and can potentially afford LTV ratios up to 80%. However, in reality, most of those looking to release equity will be looking for a far lower figure.

On a side note, check there are no early repayment charges when looking at an equity release plan.

Pros

- No age discrimination

- Calculation based on income alone

Cons

- LTV ratio may be reduced

Lifetime mortgage

The lifetime mortgage option for those looking to release equity is a hybrid of a traditional remortgage. There is still a headline interest rate, interest repayments, and capital repayment at the end of the arrangement. However, when looking at the details, it is essential to remember:

- Interest is rolled up and repaid together with capital

- There are no monthly repayments

- There is a drawdown option to take funds when required rather than in one lump sum

- The initial loan amount and interest are repaid when the property is sold

- Property is sold your on death or move into full-time care

It is safe to say that interest in lifetime mortgages has increased dramatically in recent years. Historically, there was an interest-rate premium on lifetime mortgages compared to traditional remortgages. However, this premium has reduced as competition increased with the scope for more short, medium, and long-term reductions.

Due to the element of interest on interest and the risk that property prices may not rise in the longer term, the traditional LTV ratio on a lifetime mortgage is between 45% and 58%. The older the homeowner, the higher the LTV ratio because:

- The investment duration risk is reduced

- The impact of interest on interest will fall

On the surface, this may tick many boxes for those not eligible for a traditional remortgage. However, you need to appreciate the impact of interest on interest over a prolonged period. For example, you might be paying interest on interest for 20, 30 or even over 40 years.

Upon receipt of sale proceeds, the mortgage capital and rolled-up interest would be paid off with the balance passed to the homeowner or their estate. Under new regulations, the lifetime mortgage company would not pursue the homeowner or their estate for additional funds in the event of negative equity.

Pros

- No monthly payments

- Positive impact on cash flow

- No negative equity guarantee

Cons

- Interest rates tend to be higher than those for traditional mortgages

- You will pay interest on the rolled-up interest

Home reversion scheme

Unfortunately, before recent changes and the introduction of formal financial services regulations, the home reversion scheme sector attracted more than its fair share of negative headlines. However, the concept is simple when looking to release equity from your property; it involves a part sale of your home to an investor. So far, so good.

One of the main problems is that you will only receive a fraction of the market value from the investor. In theory, if you sold a 50% share of a £200,000 home, you would expect to receive £100,000. In practice, with a home reversion scheme, you would receive anywhere between £20,000 and £60,000 for a 50% share of your home, a significant discount on the market value. There are several issues to consider, such as:

- The homeowner will live rent-free for the rest of their life or until they move into care

- No repayments with a home reversion scheme

- Duration of arrangement is open-ended, dependent upon death or a move into care

- Rent-free accommodation

To qualify for a lifetime mortgage, you need to be over 50 years of age and own your home with an element of equity. When the property is eventually sold, the net proceeds will be shared between the homeowner (or their estate) and the home reversion scheme investor on a pro-rata basis.

Pros

- No repayments

- You will live rent-free for the rest of your life or until you move into care

- Potential long-term benefit from house price growth

Cons

- Investors will pay a significant discount against the market price

- A future move to a new property may be restricted

Is equity release regulated?

Until recently, both lifetime mortgages and home reversion schemes weren't regulated by the Financial Conduct Authority (FCA). Thankfully, they now come under the remit of the FCA and are fully regulated in England, Scotland, Wales and Northern Ireland. This enhanced regulatory scrutiny should improve the quality of service providers and service to customers. It also ensures that those with a problem or complaint can directly approach the regulator. In addition, many companies offering equity release products will also be a member of the Equity Release Council, the industry's trade body.

Enhanced choice of equity release

Over 50s can find lifetime mortgages and home reversion schemes as valuable alternatives to traditional mortgages and remortgages. Historically, over 50s would struggle to secure a conventional remortgage, but significant change has occurred.

Whether considering a remortgage, lifetime mortgage or home reversion plan, you must take equity release advice from a professional financial adviser. There are various pros and cons to consider in line with your financial situation.