There are many reasons why over 50s may be looking to secure a second home. Even though UK base rates are expected to increase in the coming months, the rise is likely to be gradual. Consequently, UK residential mortgage rates are currently at or around historic lows, as are savings rates. Furthermore, despite the challenges of the Covid pandemic, UK house prices have remained relatively robust, with experts predicting more long-term growth.

Reasons for acquiring a second home

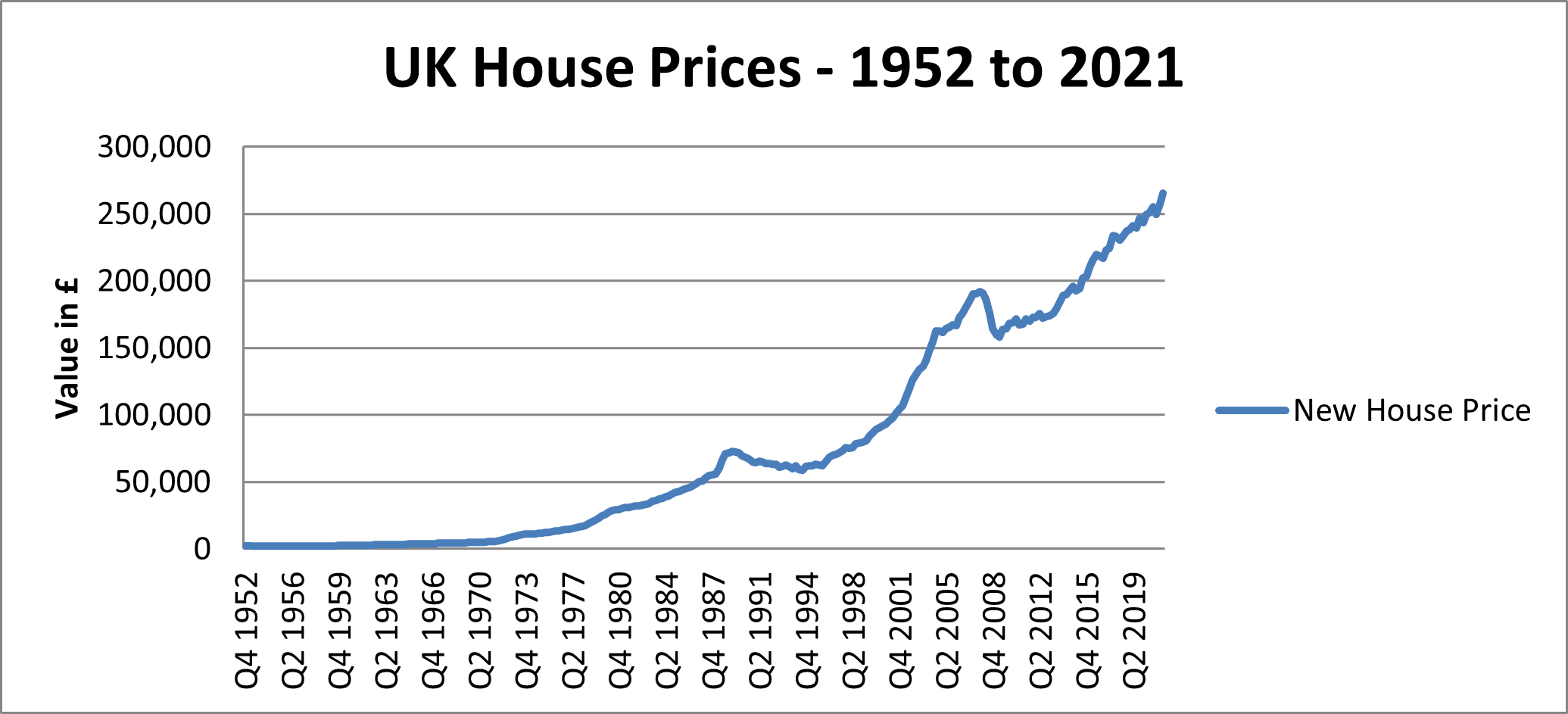

Before we look at ways to secure a mortgage for a second home, it is worth considering why people look to acquire a second property. As demonstrated by the graph below, those acquiring homes in the 1950s, 60s, 70s and 80s have, on average, seen a dramatic increase in value. This has created a considerable element of equity which can often be put to good use funding a second house.

Source: Nationwide House Price Index

To put this into perspective, a new house cost £2,107 in 1952. Adjusting this for inflation equates to a modern-day cost of £62,188. With a new house today costing an average of £265,516, that is a profit of more than 300%. So, many people will have significant equity in their homes.

What are the most popular reasons people look to acquire a second home?

Holiday home

While retirement ages have increased and living costs continue to rise, many people look towards that dream holiday home. Acquiring a weekend retreat or even a second home overseas (a little more complicated when raising mortgage capital) can provide that well-earned period of relaxation.

Buy to let investment

The UK buy to let market has increased dramatically in recent years. A mixture of demand for private rental and a reduction in local authority housing created a perfect storm for buy to let property investors. Although the government has introduced many additional taxes and charges, there are still potential rental income and capital appreciation benefits from an investment property.

Bank of mum and dad

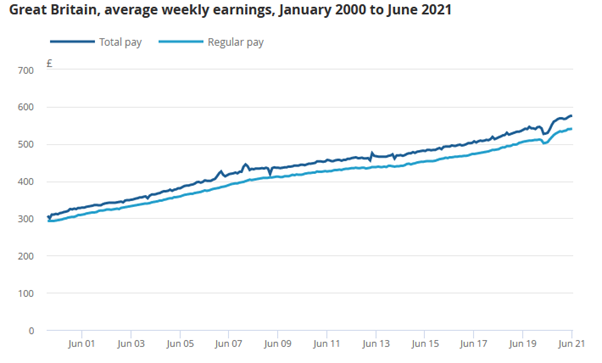

As you can see from the graph below, the average weekly pay in the UK has nearly doubled over the last 20 years. The average regular weekly wage as of June 2021 stood at £541, which equates to just over £28,000 a year. The average new house is now valued at circa £265,000. With a moderate 10% deposit, this leaves a finance gap of approximately £240,000.

Consequently, very few children flying the nest to acquire their first home will pass the mortgage affordability test. Many parents are now either releasing equity from their main home or taking out a new mortgage, with monthly repayments covered by their children. A helping hand onto the first rung of the property ladder!

Source: ONS

Retirement planning

Historically, property investment has performed admirably in the UK, as you can see from the earlier house price graph. However, as many people approach retirement, they begin to look at their dreams and how their lives may change. As a result, you’ll often find individuals and couples acquiring an additional property as they approach retirement age. In addition, the acquisition of a second property opens up the potential to rent out their original home to create a significant income stream.

Securing mortgage funding when you’re over 50

There are several options for over 50s looking to secure a mortgage for a second property. The power of the so-called “grey pound” in the UK has increased dramatically in recent years, creating a new financial sub-sector. The options available will sometimes, but not always, depend on your financial status.

Traditional mortgage

Since the 2008/9 US mortgage crisis, which led to a worldwide financial crash, the authorities have clamped down on “reckless lending”. This led to the introduction of an affordability test for traditional mortgage finance. The affordability test will consider:

- Single or joint income

- Spending on bills

- Other regular payments

The idea is simple: is there sufficient capital available to cover mortgage payments after your living expenses? The test will consider the deposit on a property, which is traditionally around 15% but can vary between lenders. There are also other issues to consider with a traditional mortgage application.

Age

Age limitations for mortgage applicants will vary between individual lenders. As more people work into their 50s, 60s, 70s, and sometimes even longer, your ability to secure finance can be enhanced. For example, an applicant in their 50s with minimal income may fail a traditional mortgage application test. However, someone in their 70s with regular income may be able to secure a mortgage. You might require the services of a mortgage broker to find the best deal for your situation.

Retirement plans

While many people look for the traditional 25-year mortgage, applicants over 50 may need to consider a shorter-term arrangement for their first property. Finance providers tend to stipulate that the mortgage is repaid on the applicant’s 70th birthday or upon retirement, whichever occurs first. Therefore, you need to have a solid plan for repaying your mortgage, including redemption of policies, pension tax-free lump sum and additional income in later life. Some specialist mortgage companies may provide finance for those in their 80s or even 90s.

Remortgaging an existing property

As demonstrated above, many over 50 homeowners will have significant equity. While some may have a relatively small existing mortgage, many will have paid off their mortgage in full. This prompts the question; why not simply remortgage the existing property to raise funds for a second home? Pay off your current mortgage and take out a new fixed-rate deal?

Unfortunately, when looking to remortgage your primary residence, you may fall foul of an affordability test or low credit score. For example, suppose you cannot demonstrate you have sufficient income to cover your monthly mortgage repayments. In that case, you will likely be rejected even if you have a significant element of equity in your existing home - frustrating!

A report by Sun Life highlighted the shift in retirement age in the UK. Amongst those who have already retired, the average retirement age was 59. However, for those looking to retire in the future, 33% have changed their plans due to the pandemic, with the average retirement age now 64. Consequently, those looking to remortgage their main residence, supported by regular employment income, may need to extend their retirement date.

While not as common as they once were, be careful of early repayment charges written into your mortgage deal!

Lifetime mortgage

Many older homeowners have significant equity in their property, often with no mortgage. This has spawned a new financial instrument, the lifetime mortgage. There is no income requirement with a lifetime mortgage, although there are other issues to consider.

No affordability test

As traditional mortgages require regular payments, many older homeowners fall foul of the affordability test. However, there is no such requirement for a lifetime mortgage. Instead, funds are borrowed against the property on an open-ended repayment basis - a secured loan.

Together with rolled-up interest payments, the mortgage will be repaid upon the death of the last of the homeowners or their transfer to long-term care. At this point, the property will be sold, the mortgage repaid together with rolled-up interest, and additional capital returned to the individual or their estate.

LTV ratio

The loan to value (LTV) ratio is a crucial factor in mortgages. A traditional mortgage may allow an LTV ratio of up to 95%. However, the LTV range is generally between 45% and 58% with lifetime mortgages, accommodating for rolled-up interest and potential price changes.

Retain ownership of property

While the lifetime mortgage company will hold a legal charge over the property, for the outstanding mortgage and rolled-up interest, ownership remains with the homeowners. The capital and interest can be repaid at any time, which would then remove the legal charge. However, there may be early repayment penalties.

Rolled up interest payments

As we touched on above, the lifetime mortgage payment will attract interest, generally rolled up and repaid on the sale of the property. Consequently, the final repayment will include an element of interest on interest. It is not inconceivable for a lifetime mortgage to last 20 or 30 years and even longer, leading to a significant amount of rolled-up interest.

Moving house

It will depend upon the lifetime mortgage provider. Still, you may be able to move property in the future without early repayment of the lifetime mortgage plus interest. This would require a simple transfer of security from the previous property to the new property. However, if you were to downsize, you may be required to repay part of the mortgage, depending on the new LTV ratio.

Negative equity guarantee

In the early days, the interest charged on lifetime mortgages was relatively high compared to their traditional counterparts. While there have been improvements of late, you will currently pay a higher interest rate on a lifetime mortgage. Historically, many people were concerned about slipping into negative equity because of the rolled-up interest and potentially stagnant property prices.

Due to an element of self-regulation and pressure from the authorities, there is a negative equity guarantee with all lifetime mortgages. This ensures that the maximum you will need to repay is the sale proceeds of your property. Even if this is less than the amount owed, the lifetime mortgage company will not pursue you for the balance.

No restrictions on the use of capital

Whatever your reason for acquiring a second property, there are no restrictions on how you can spend the capital raised. When gifting funds to children, you may need to consider any potential inheritance tax liabilities. However, you are free to spend the money as you wish!

Home reversion schemes

As with lifetime mortgages, home reversion schemes are available for homeowners over 50. Due to the structure of these schemes, the applicants don’t need to provide evidence of income. The concept is simple; the home reversion company will pay you to acquire a share of your property. Unfortunately, there are some critical issues of which you should be aware.

Market value discount

While home reversion schemes are a type of equity release, you will only receive between 20% and 60% of your property’s true worth. So, for example, let us assume you are selling 50% of your home, valued at £200,000.

Property value: £200,000

Share of property sold: 50%

Market value: £100,000

Home reversion plan payment: £20,000 to £60,000

In theory, the home reversion company could obtain a share in your property worth £100,000 for as little as £20,000.

No monthly repayments

As the home reversion company is simply acquiring a share of your property, there are no funds to repay and, therefore, no monthly repayments. This also avoids the traditional mortgage affordability test, often restricting access to finance for the over 50s.

Rent-free accommodation

As part of a home reversion plan, the homeowners will live in the property rent-free until the last homeowner dies or is transferred into long-term care. If the homeowners sell 100% of their property, ownership will reside with the home reversion company; otherwise, ownership will be shared.

Property sale

The property will be sold when the last homeowner moves into full-time care or dies. The home reversion company will receive their share of the sale proceeds. In the above example, the property’s value may have increased to £500,000 when sold. The home reversion company would receive £250,000 for an investment of as little as £20,000. It is important to note that the homeowners will live rent-free in the property for anywhere up to 40 years or even longer.

Numerous options when looking for a second home mortgage

While it will depend upon your financial circumstances, there are potentially several options available if you’re over 50 and looking to raise mortgage capital. However, each option has pros and cons, and some may not be applicable due to the affordability test.

You will also need to consider the deposit required, stamp duty, arrangement fees and other associate costs. Whether or not it is your first mortgage, it is crucial to obtain professional mortgage advice from a broker to ensure that you take the correct course of action. For those who are not aware, the UK financial sector is regulated by the Financial Conduct Authority (FCA) - covering England, Scotland, Wales and Northern Ireland.