While free healthcare is available to everyone in the UK through the National Health Service (NHS), waiting lists can be long, and treatment options are sometimes limited. Furthermore, the Covid-19 pandemic exacerbated what was an already growing issue. The King's Fund healthcare charity reported that by December 2020, more than 220,000 people were waiting for routine planned care for more than a year, compared to just 1,500 people in December 2019. So it is no wonder that people are turning to private healthcare options in droves.

If you are in your 50s, you may start to think about your medical care options and your needs in later life. This could be an excellent time to explore private health insurance. The challenge is to find a policy that will meet your needs and suit your budget. Health insurance cover, like life insurance, gets more expensive the older you get.

As you age, you are also more likely to develop health conditions. Unfortunately, insurers will usually not cover you for pre-existing health conditions. This can make taking out a policy even more complex, particularly if you want to cover a pre-existing condition.

However, if you take your time to explore the options available to you in your specific circumstances, you may find that there are ways for you to get the level of cover you need and the private treatment options you're looking for.

What insurance options do I have?

There are several options available to you if you are considering health insurance. Of course, the best policy for you will depend on your circumstances. For example, if you live on your own, you might consider taking out a solo policy. But if your children still live with you or if you live with your partner, a family or joint policy could be more appropriate. And if you have pre-existing conditions, there are moratorium policies available that do not require medical underwriting.

Do you live alone? An individual policy could meet your needs

If you live alone, you will most likely opt for an individual policy that will cover just yourself. A basic policy will cover most of your inpatient treatments, including surgeries. You could also get a private room when you're hospitalised.

More comprehensive policies will include outpatient treatments, including referrals to specialists. It is essential to check your policy to see what type of outpatient cover is available to you if this is important to you. Some policies will exclude outpatient cover altogether to try and keep costs as low as possible.

While inpatient cover will be helpful if you require hospitalisation, you will need outpatient cover for things like specialist and consultant referrals.

You will also have the option to add on services if you wish to make your cover even more comprehensive. You could look into mental health cover, dental cover, and cancer cover, for example.

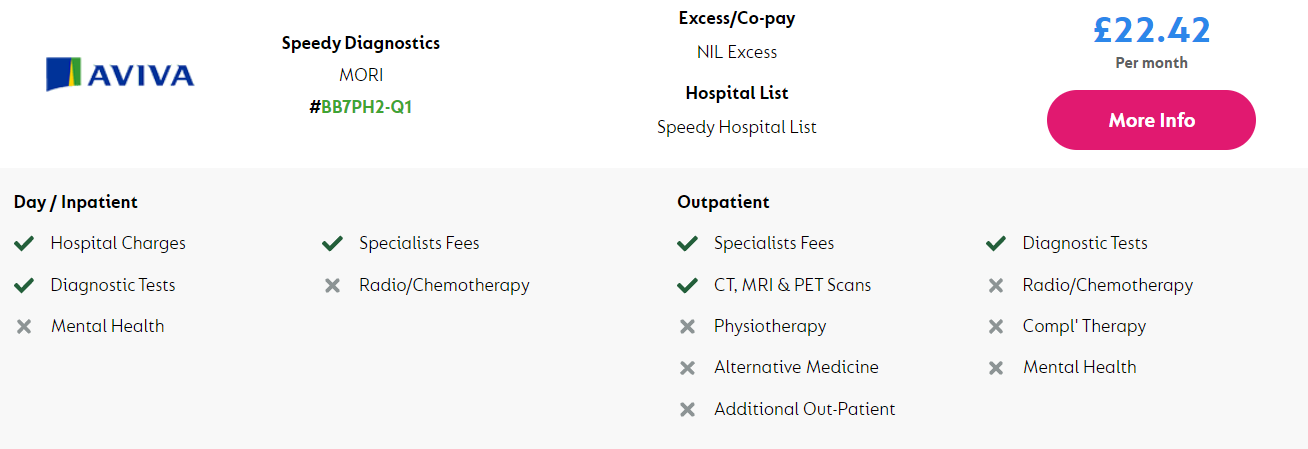

To give you an idea of how much you might pay, we created a fictitious 51-year-old non-smoker and used GoCompare to view prices. Her quotes started at around £22 per month for a basic policy without outpatient cover.

Do you live with your partner? A joint policy could save you money

A joint policy would cover you for the same things as an individual policy. However, this is a great option to explore if you live with your partner and they are also interested in a health insurance policy. You will generally get cheaper insurance if both of you take out a policy rather than insuring yourselves individually.

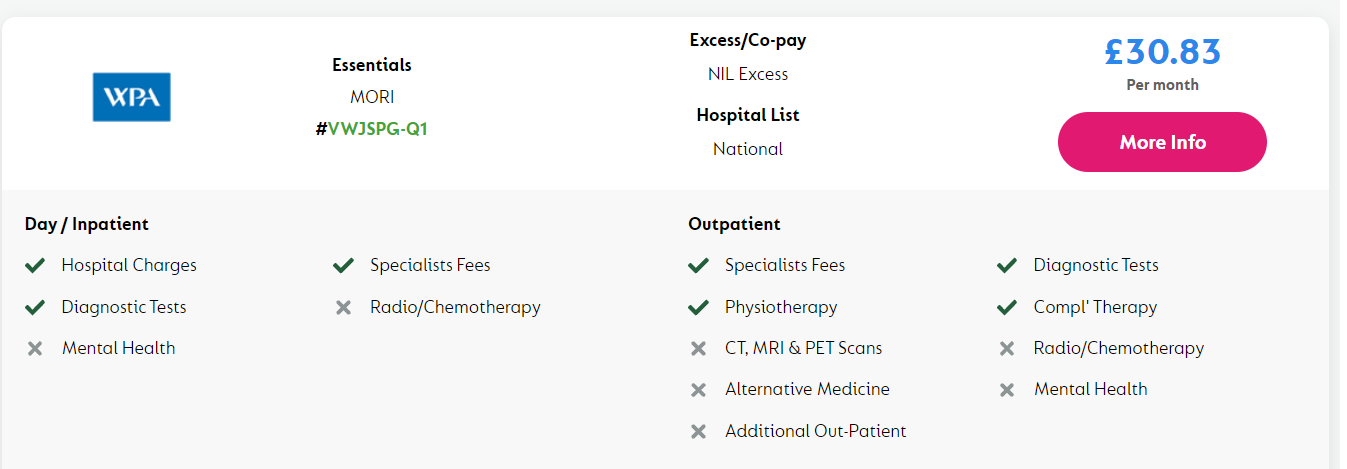

To give you an idea of how much you could save, we added a fictitious 51-year-old male, non-smoking partner to our example above. The cheapest policy was now priced at around £31 per month for a joint policy, resulting in a significant saving versus taking out two policies.

Do your children live with you? A family policy might be best

A family policy will work best if you want the whole family to benefit from private medical insurance. This type of policy usually covers everyone in your household and offers a sizeable discount, which could work out cheaper than insuring everyone individually. This will be much more efficient, too, because you will only be paying one premium rather than having to worry about multiple payments.

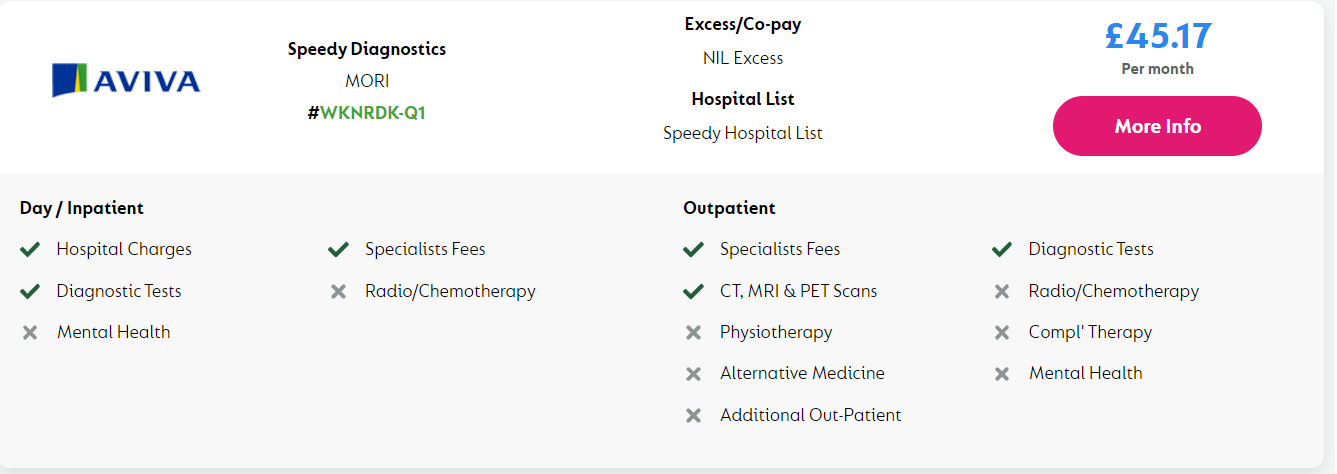

To see how our policy quotes would change if we added children, we kept everything in the above examples the same but added a 12-year-old boy and a 15-year-old girl to the above policy. Our cheapest option now cost around £45 per month, illustrating there is value in opting for a family policy if you have dependents.

Do you have a pre-existing condition you want to cover? Moratorium underwriting could be an option

Some health insurance policies require you to fill out lengthy questionnaires about your current health and lifestyle. Your insurer may even seek information from your GP before insuring you. However, you will not usually be covered for pre-existing conditions. So what happens if you have a medical condition that you want to be insured for in future?

One option to consider is moratorium underwriting. This type of policy does not require you to declare any pre-existing conditions before taking out cover. However, your insurer will contact your GP and look at your medical history before processing any claims you make. If they find that you have had a pre-existing condition in the last five years, they will usually refuse to pay out.

But, if you haven't received treatment, medication, or consultations for the pre-existing condition within a specified period after taking out the policy, the insurer will start covering you for it again if you develop it at a later stage.

This is one way to obtain cover for a pre-existing medical condition. However, it can be more expensive than a policy that comes with full medical underwriting. Also, your insurer will need to assess each claim before paying it out, making for a lengthier process in general. If you're interested in covering a pre-existing condition, speak to an insurance broker who will be best placed to assess your individual circumstances. We have an excellent guide here to help you get the most out of your insurance broker.

How to keep your health insurance cheap in your 50s

The above quotes illustrate that affordable health insurance is still available to you in your 50s. But how do you keep quotes as low as possible if you're on a budget? There are several options to consider if you are looking to save money.

- Opt for an NHS waiting period – Some policies allow you to lower costs by opting to be treated on the NHS if medical treatment is available within six weeks. However, if the waiting period is longer than six weeks, you can be treated privately. If you are happy to be treated through the NHS and a six-week wait is acceptable, this could be a great way to bag an affordable premium.

- Pick your excess wisely – A £0 excess may sound appealing as it will mean you do not have to pay anything if you wish to claim on your insurance. Still, it is worth checking how much you could save by upping your excess slightly. For example, some policies allow you to set an excess per claim. In these cases, you would be expected to cover a certain amount per claim. Alternatively, you may be able to set a rolling excess where you contribute a set amount per year, after which your policy becomes excess free.

- Limit the hospitals you're accessing – Health insurance policies will offer different hospital options. If you opt for a limited choice within your immediate area, you could save on your premium. However, your premium will likely go up if you wish to add national cover or national cover including London hospitals.

- Avoid unnecessary add-ons – A great way to lower your premium is to be clear on what you want from your insurance from the start. The level of cover you opt for could affect your premium. Don't add extras just because you've been offered them. For example, do you really need mental health and cancer cover? These may well make sense for you and your family. Still, it is worth seeing what's covered by your policy and what's covered by the NHS before locking yourself in.

- Consider lifestyle choices – Regardless of whether you're opting for moratorium underwriting or full medical underwriting, health insurance providers will ask whether you smoke or not. You could save a significant amount on your policy by quitting if you are a smoker. Also, losing weight if you're overweight could bring your premium down further.

- A no-claims discount counts – As with other types of insurance policies, not claiming on your insurance could bring your premium down the following year. When considering your health insurance options, ensure that you ask about your insurance provider's no-claims discount policy.

- Shop around - Get a few health insurance quotes before you pick your health insurance plan. Comparison websites take the hassle out of approaching different insurance companies for quotes. The cheapest insurance policy might save you money, but it may not be the best policy out there. Make sure to refer to websites like Trustpilot and check insurers' reviews before purchasing a policy. The best policy for you shouldn't break the bank, but it should provide the level of cover you require for yourself and your loved ones.

A guide to over 50s health insurance

Health insurance is a great way to get some peace of mind if you're worried about long waiting lists and limited medical treatment available on the NHS. There are plenty of affordable policies that could offer the cover you need and fit your budget. While your premium will go up as you age, your 50s are a great time to bag affordable insurance cover.

If you have a partner or are still raising teens, it makes sense to consider joint or family health insurance cover. These types of policies usually work out cheaper than individual coverage and are easier to manage. If you have a pre-existing health condition you hope to be covered for eventually, you could look into moratorium underwriting.

If you are worried about the cost of your premium, there are several ways to save money. For example, you could opt for an NHS waiting period, limit the hospitals you're accessing, avoid unnecessary add-ons, and make use of your no-claims discount. Shopping around and getting multiple health insurance quotes will likely get you the best deal and your premium will depend on the level of cover you require.

Whether health insurance is worth it to you is a personal choice. Free healthcare is available to everyone in the UK through the NHS. However, private health insurance does offer a broader range of medical treatment options for you and your loved ones. There are affordable options available if you opt for private health insurance.