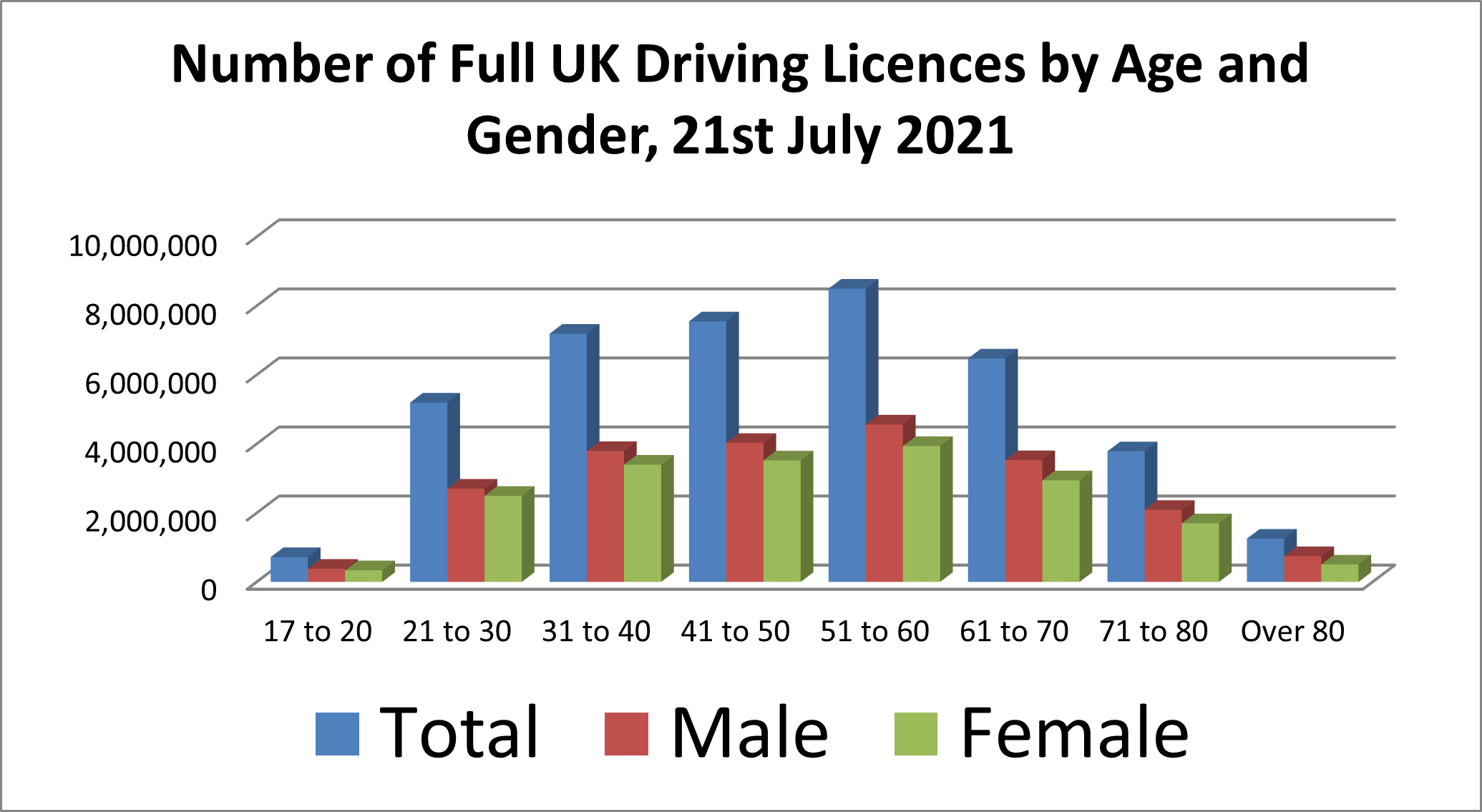

When looking at car insurance for older people, there are several anomalies you may be unaware of. Firstly, the following graph gives you an insight into the number of full UK driving licences held by age group then split by gender. It will surprise many to learn that more people over 80 years of age have a full driving licence than young drivers between 17 and 20.

Indeed, out of a total of 40.6 million full driving licences in July 2021, there were 20.6 million holders up to 50 years of age and 20 million over 50 years of age. Consequently, the over 50s, 60s, 70s and 80s insurance market is probably more competitive than you imagined.

Source Data: DVLA

Are older drivers more likely to have an accident?

There is a general misconception that the older the driver, the more chance of being involved in an accident. As a result, you will often notice car accidents involving older drivers, sometimes in their 90s and above, tend to grab the headlines. We then get the stereotypical call that older drivers pose a more significant threat and should have their licence revoked. However, is this the case for all older drivers?

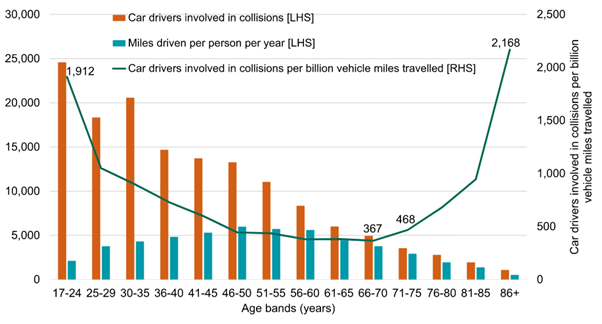

The BBC published an article about accident rates back in 2016, using research data provided by Swansea University. The research showed that drivers aged 70 were involved in 3 to 4 times fewer accidents than drivers aged 17 to 21. As you can see from the graph below, the number of drivers involved in collisions per billion vehicle miles travelled shows a consistent fall from age 17 to 70. After that, the rate rises sharply the older the driver.

Source: https://toptests.co.uk/driving-statistics/

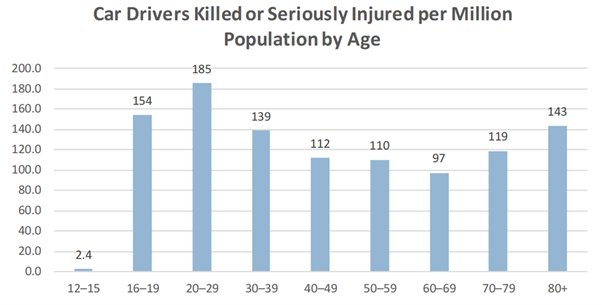

The following graph also supports the claim that the safest driving age group is those aged between 60 and 69, which may surprise many people.

Source: https://toptests.co.uk/driving-statistics/

It is unclear why those in their 60s appear to be the safest drivers, although it may have something to do with driving experience, confidence and general health. While there are exceptions to the rule, insurance premiums will typically rise for policyholders after 70 years of age.

Is there a tipping point for the cost of car insurance?

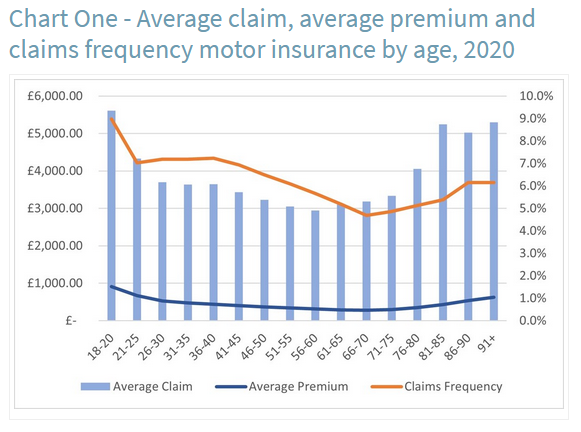

The whole concept behind a car insurance policy is the risk/reward ratio. The higher the risk of the driver being involved in an accident, the greater the premiums. Consequently, the following graph again reiterates that drivers in their 60s have consistently been the safest age group. However, as you will see below, those in the 56 to 60 age bracket have the lowest average claims on their insurance.

Source: https://www.abi.org.uk/products-and-issues/choosing-the-right-insurance/motor-insurance/age-and-motor-insurance/

It is easy to fall into the trap of automatically assuming that everybody will appreciate the� safe driving record of those in their 60s. Unfortunately, this is not always the case. You may find that non-specialist insurance companies will offer higher premiums for older drivers because this is not their primary market. Consequently, it is essential to shop around and look at the many insurance companies now offering specialist car insurance for older drivers.

Equality laws mean it is now illegal to charge different insurance rates for males and females where all other issues are equal. Therefore, the infamous concept of charging male drivers more than their female counterparts, based on perceived gender risk, is no more.

Does age make a difference to your car insurance premiums?

While it is illegal to discriminate against somebody due to their age, there are several factors to consider as we grow older. While these issues are generalisations, there are numerous exceptions to the rule, but many of us will recognise some of these issues:

- A more cautious approach to driving

- Uncomfortable on fast roads

- Increased number of health issues

- Reduced coordination

- Limited flexibility

- Impaired hearing

- Extended reaction times

- Difficulty in multitasking

- Eyesight issues

General insurance premiums are calculated by analysing the average driving performance of someone in your age group. Therefore, the above health issues may come into play and specific health challenges unique to you. You must inform your insurance company of any health difficulties; otherwise, this could void your insurance.

It is essential to be aware of your own potentially failing eyesight as you get older. You will also need to renew your driving licence when you turn 70 and every three years thereafter. There is no charge for renewing your license in later years, with the appropriate form sent just before your 70th birthday.

How can you reduce your premiums?

When looking to reduce your car insurance premiums as you age, there are many factors you can take into consideration. You may be referred to as a mature driver when aged over 50 and with many years of experience but you can still reduce your premiums if you:

- Drive a relatively low powered vehicle

- Consider a telematics policy, which involves the installation of a “black box”

- Reduce the number of miles you drive each year

- Employ the services of a specialist insurance broker

- Opt for comprehensive cover

- Avoid taking unnecessary add-ons, although you may wish to retain options like windscreen cover

Occupation

Insurance companies will consider your occupation when calculating your car insurance premiums. An Insurance Business Magazine report highlighted the ten most expensive and inexpensive job titles when looking at car insurance.

The more expensive job titles include:

- Recruitment consultant

- Designer

- Social worker

- Councillor

- Physiotherapist

- Midwife

- Nurse (though if you work for the NHS you will usually qualify for a discount)

- Hairdresser

- Senior manager

- Supervisor

The ten least expensive job titles include:

- Driver

- Secretary

- Personal assistant

- Barrister

- Software developer

- Web designer

- Web developer

- Software engineer

- Programmer

- Developer

Those who follow the car insurance policy classification categories will be aware that they change regularly. Keep an eye on the press!

While your insurance company cannot reclassify your employment mid-policy, they may review your premiums upon renewal. Consequently, it is always sensible to obtain several quotes as your renewal date approaches, to give you an idea of what other insurance companies would charge you. In some cases, this can be used as a means to negotiate with your existing insurance company!

Car insurance cover for over 50s

When looking for car insurance quotes as someone over 50, you should be able to obtain competitive quotes from most car insurance providers. There are some specialists in over 50s car insurance that include:

- Age UK

- Rias

- Saga

A recent report in the London Evening Standard suggests that the average annual car insurance premium for a 45-year-old driver is £575. The comparable quote for a 55-year-old driver, assuming all other things are the same, came in at £468. This perfectly ties in with the ever-reducing accident rate, which bottoms out in the 60s and then starts to rise again.

Car insurance cover for over 60s

Statistically, drivers in their 60s are the least likely to have an accident, so car insurance rates are relatively competitive in this area. If you have a clean licence, no claims bonus and are relatively healthy, this will probably be the lowest car insurance rate you will ever be quoted. As an experienced driver you tend to find that the insurance companies will include several add-ons such as:

- Breakdown cover

- No claims discount protection

- Courtesy car

- Lost keys

- Emergency driver cover for your vehicle

Comparing and contrasting car insurance quotes and the offers available via specialist car insurance companies against traditional providers is essential. Just because they are specialists does not necessarily mean they will be the cheapest. However, specialist insurers can be helpful when you have a particular issue, such as a health problem or a chequered driving history.

Car insurance cover for over 70s

As we touched on above, when you begin looking at comprehensive car insurance over 70, you will see premiums start to rise. The earlier graphs demonstrate the sharp rise in accidents and claims for over 70s. Even though your driving history, no claims bonus and healthy medical background will help, there is a general upturn in premiums for all drivers in this age bracket. When looking to reduce your premiums, and save money, there are several options:

- Reduce your annual mileage, reducing your chance of having an accident

- Increase your excess, reducing your insurance company’s liability

- Purchase a less powerful vehicle

It is unfortunate, but statistically, the risk/reward ratio begins to move against insurance companies with drivers over 70. However, thankfully this is still a relatively competitive market, and there should still be many options available to you. We all know that we should gather a number of quotes as we approach renewal of our car insurance, now is the time to do it. As you will find, not all insurance companies think the same way!

When you approach 70, you will receive correspondence from the DVLA asking you to conduct a self-assessment. The self-assessment form will include questions about your health, fitness, medical conditions and eyesight. You will need to renew your licence every three years, but there is no requirement for any medical examinations.

Car insurance cover for over 80s

While most specialist car insurance companies will have no upper age limit on their insurance, you may be declined for many reasons. These might include:

- Poor claims history

- Convictions

- High rate vehicle

- Deemed medically unfit by the DVLA

You will notice that many of the insurance companies offering car insurance to those over 80 will ask for confirmation that the DVLA has deemed you medically fit and safe to drive. Even though some people will drive into their 90s and beyond, knowing when to call it a day can be difficult. The problem many older drivers have is that their vehicle is their primary form of independence. Take this away, and much of their social life and integration with the community disappears.

Elderly drivers are highly advised to obtain several quotes when looking to insure their vehicle. This is an area of the market dominated by specialists, with many people employing the services of an insurance broker. Unless you have a particularly patchy driving record, you will likely be able to gain a quote, but there will be a significant difference between your 60s and 70s.

In all cases, choosing a comprehensive policy should also help you keep costs low.

Shop around for insurance deals

When looking for car insurance quotes, you may find it helpful to broach the subject of home insurance. As many general insurers offer a range of different insurance policies, such as car insurance and home insurance, you may be able to negotiate a bulk package. So how are insurance companies able to offer discounted package deals?

When an insurance company secures a new client, this will likely involve an additional cost such as advertising or commission to a third party. However, if you approach your insurance company about car insurance and home insurance, this negates the advertising/commission cost to a certain extent. Consequently, the insurance company can offer a discount on the entire package while still maintaining the same level of profitability. You will be surprised at the potential savings out there!

Car insurance market for older drivers is still competitive

Many people will likely be surprised to see some of the statistics in this article. While older drivers often receive negative press comments, a driver aged between 17 and 21 is three or four times more likely to be involved in an accident than a 70-year-old driver. While the market for over 50s and over 60s car insurance is relatively competitive, you will see a significant increase in premiums for those aged 71 and above. Therefore, it is crucial to shop around and even consider employing the services of an insurance broker.