The massive mis-selling scandal surrounding PPI has been a wake-up call for many finance companies and consumers. While time will tell, there is a belief amongst some experts that PCP could be the next form of finance to come under the microscope. The concept itself is straightforward, put down a deposit and pay monthly instalments, but there are concerns about suitability for some individuals. So before we look at the potential issues surrounding PCP, it is worth reminding ourselves exactly what this type of finance involves.

PCP finance explained

Personal Contract Purchase (PCP) finance was introduced to the UK back in 1992 by the Ford Motor company. Already popular in North America, the high expectations for PCP finance have been achieved, and more in the UK. The concept behind PCP is relatively simple:

- Make a deposit

- Pay monthly instalments (generally between 24 months and 36 months)

- Agree on annual mileage

- Receive a quote for Guaranteed Minimum Future Value (GMFV)

The GMFV is the estimated value of the vehicle on the expiry of the PCP agreement. Once the GMFV has been calculated and added to your agreement, it cannot be changed. So, if the vehicle were worth more on the expiry of the PCP, you would be entitled to this excess. However, if there were a shortfall, the finance company would take the loss.

On the expiry of a PCP contract, there are the following options:

- Buying the vehicle outright by paying the GMFV

- End the agreement, handing the vehicle back to the finance company

- Part exchange your vehicle for another car

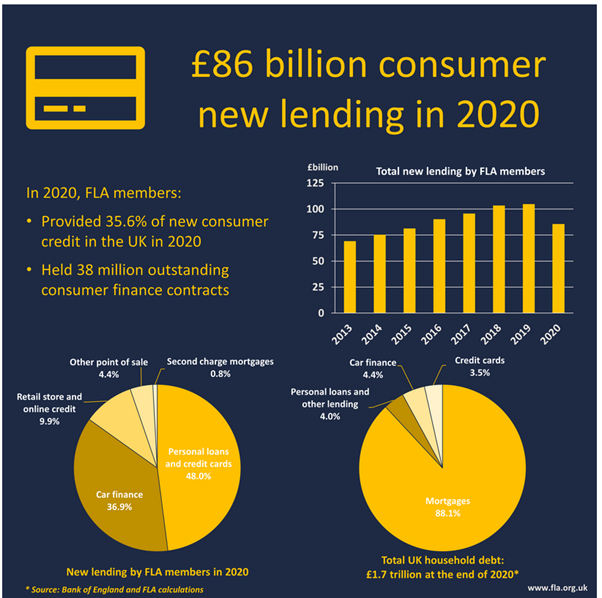

The deposit, monthly instalments and annual mileage will reflect your circumstances. When you consider that PCP finance gives people the option to acquire vehicles that they "couldn't normally afford", it is no surprise to see it has become very popular. The following graph from the Finance and Leasing Association illustrates the size of the PCP market.

Source: https://www.fla.org.uk/research/consumer-finance-key-statistics/

Some reports suggest that PCP finance now accounts for circa 80% of new car purchases (while others are as high as 91%). The figure is similar for "nearly new" vehicles up to 5 years old. Consequently, using the figures above, PCP car finance in 2020 equates to approaching £25.4 billion. If we use the same 80% assumption for household debt, current car finance equates to £74.8 billion, with PCP accounting for circa £60 billion.

As a consequence of the Covid-19 pandemic, the Bank of England and the Finance and Leasing Association have expressed concerns about car finance levels. So, what are the potential drawbacks with PCP finance, and why is there growing concern regarding potential mis-selling?

What is a typical PCP deal?

When looking at financial arrangements, you tend to find that the devil is always in the detail. Therefore, the best way to demonstrate this is with a practical example.

Cost of vehicle: £20,000

Deposit: £2,000

PCP Loan: £18,000

PCP Duration: Three years

GMFV: £8,000

As we touched on above, the GMFV value is set in stone as soon as your agreement is signed. So in effect, you only have net borrowings of £10,000 (adjusting for the GMFV value) over three years. However, this is where it starts to get a little complicated.

Total capital repayments: £10,000

Interest charged on: £18,000

Even though you will only repay £10,000, plus interest, the interest charge will be calculated on the total £18,000 PCP value over three years. £8,000 of this is backed up by the vehicle's GMFV, but you will still pay interest on that amount. Unfortunately, many people fall into the trap of assuming they will pay interest on the £10,000 difference between the purchase price and the GMFV; this is not the case.

Financial mis-selling

While many people will be aware of PPI mis-selling and the billions of pounds in compensation paid by UK banks, there are serious concerns regarding PCP. When discussing PCP arrangements concerning car finance, the lender is obliged to:

- Disclose all costs

- Detail full liabilities

- Discuss options available

- Interest charge

- Monthly repayments

- Disclose third-party arrangements

There is a general misconception that you can only claim financial mis-selling if you make an actual monetary loss. In reality, it is relevant whether or not you make a financial loss. For example, if the terms of the PCP arrangement weren't disclosed in full, or the arrangement was not “right for you”, then you may be able to claim mis-selling.

Issues to be aware of with PCP contracts

When taking out a PCP car finance contract, you must be aware of various obligations.

Return of the vehicle

If you decide to return the vehicle at the end of your PCP arrangement or make up any difference after more than 50% of your PCP finance has been repaid, it must be in good condition. On a positive note, there is another misconception that the vehicle should be returned spotless after three years of use. This is neither feasible nor viable, and the finance company will accept a degree of wear and tear.

Windows and glass

If all window and glass repairs have been carried out professionally, this will not be an issue with a finance company. However, if there are chips and substandard repairs on the windscreen or headlights, you will likely be charged for additional repairs.

Wheels and tyres

So long as damaged alloys have been repaired and the tyres have the correct degree of legal tread, there should be no difficulties. However, scraped or dented alloys, illegal tyres and incomplete repair kits will incur a charge.

Mechanical condition

To drive your vehicle, it must have a valid MOT, and it is the same when returning your vehicle. You will be charged for repairs if the car is returned with warning lights, worn components such as brake discs, and engine or gearbox issues.

Interior

As we touched on above, over three years, a vehicle will experience a degree of wear and tear. Finance companies appreciate this but will not accept damage to the interior above and beyond the "normal".

When you return your vehicle, it will be inspected by the finance company, and you get a report. If you believe there are discrepancies or disagree with elements of the report, you can arrange your own inspection. However, whether or not the finance company would take into account a third-party assessment is debatable.

Consequently, the finance company must make you aware of the potential repair obligations when returning the vehicle. Failure to do so could constitute mis-selling.

Annual mileage

It is essential to be aware of annual mileage, which will form part of your PCP arrangement. In simple terms, the finance company will stipulate a maximum yearly mileage allowance to protect the vehicle's long-term value - to a certain extent. But, unfortunately, not everybody who takes out a PCP arrangement will appreciate or understand the additional charge, above and beyond the annual mileage allowance.

If, for example, the PCP annual mileage allowance was 5000 miles and you did 10,000 miles a year, there would be an additional charge. It is not uncommon for an additional charge of 10p a mile to be made by the finance company. This equates to £500 per annum, which over three years creates another liability of £1500.

When taking out a new PCP arrangement, car dealers may adjust the annual mileage allowance. This can help to create a package that is "too good to be true". If you have requested a like-for-like refinancing deal and adjustments were made to, for example, the mileage allowance, this is not allowed. Everything needs to be transparent and above board, and buyers need to be aware of their actual/potential obligations. Be careful!

Returning the vehicle early

One area of concern regarding PCP car finance contracts is the ability to return the vehicle early. Under the Consumer Credit Act 1974, this is possible when you have made payments covering at least 50% of the total amount payable. In the above example, where you borrow £18,000 but are only repaying £10,000, many assume you can return the vehicle when you have reimbursed £5,000 in capital plus interest. Unfortunately, this is not the case.

The 50% level at which you can return the vehicle is based upon the total borrowings of £18,000. Therefore, you will need to have repaid at least £9000 plus interest before you are eligible to return the vehicle.

It is essential to ask for a settlement figure if you are looking to terminate your PCP agreement early. If the outstanding amount is more than the vehicle's value, you will be asked to make an additional contribution. Alternatively, if the car is worth more than the outstanding balance, you will be entitled to the excess.

Part exchange for another PCP vehicle

Many people choose to exchange their vehicle at the end of a PCP arrangement to acquire a new PCP funded vehicle. In theory, this is very straightforward. Just before your final repayment, the car will be valued (taking into account the GMFV). If the vehicle is worth more than the guaranteed GMFV, you will have "equity" to carry forward into a new PCP deal. As most PCP arrangements involve a rather conservative GMFV figure, many people find themselves in this situation.

At this point, it is worth remembering that the GMFV figure is guaranteed so, in a worst-case scenario, upon your final repayment, the value of the vehicle will offset the remaining loan. There have been reports of car dealerships encouraging customers to roll over their PCP arrangements, for which they would receive a commission. The deal presented to a customer must be appropriate for their personal and financial situation.

As we touched on above, it is also essential to be aware of situations where perhaps the annual mileage allowance has been adjusted to create that “too good to be true” deal. Do not automatically assume that you are moving to a like-for-like PCP arrangement. While the car dealer must be transparent and upfront, you also must understand the fine print of a PCP arrangement.

What to do if you suspect PCP mis-selling

If you suspect that you may have been the victim of PCP mis-selling, there is a clearly defined complaints process.

Gather evidence

You must gather as much information as possible to support your claim for PCP mis-selling. Unfortunately, it is unlikely that any car dealership/finance company would go out of their way to find evidence against themselves. This illustrates why your need to retain all paperwork, even for a period after your PCP arrangement has finished. It may only become apparent further down the line that you have been the victim of PCP mis-selling.

Complain to the car dealership

All companies need to have a formal complaints procedure. So, you should contact the car dealership that arranged your PCP finance and request details of their complaints procedure. Forward details of your complaint, together with supporting evidence, and ask for their comments. The vast majority of legitimate complaints are rectified at this level. However, if you are unhappy with the response, you can take this further.

Financial Ombudsman Service

The Financial Ombudsman Service is tasked with looking into business arrangements where there may have been misconduct. As an independent body, they will review each complaint without bias. The Financial Ombudsman Service is a potent authority. In the vast majority of cases, their ruling will be the final decision.

Where a complaint is upheld, the ombudsman will work with the car dealership to arrange compensation for the victim. Part of the ruling will likely involve early termination of the PCP agreement.

Court

While possible, but very rare, a car dealership might contest the ombudsman's ruling through the courts. In this scenario, the claimant could face high court costs and may need to rethink their approach.

It is crucial to pursue potential mis-selling of PCP finance; otherwise, this issue will never be addressed. Money talks in the business world, and it is only when hit in the pocket that many companies will sit up, listen and look to revise their procedures.

Are you protecting yourself from PCP mis-selling?

As we have covered above, there are numerous issues to consider when looking at PCP car finance. Even though car dealers/finance companies have a legal obligation to make you aware of all elements of the contract, it is up to the customer to ask questions where they are not sure.

A report by The Car Expert website found that a staggering 90% of people did not fully understand the fine print of their finance contracts. Even more concerning, research from 2015 confirmed that 88% of men and 75% of women were not aware of how PCP contracts worked. Even though PCP finances more than 80% of new/used vehicle purchases!

So, is this a case of consumer ignorance or car dealership mis-selling? Only time will tell.

Image Credit: Andrea Piacquadio at Pexels