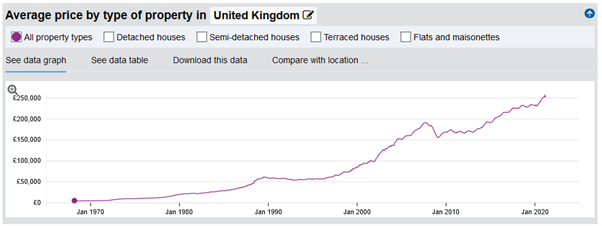

Even if we use the Land Registry average house price index, which lags the more popular Nationwide House Price Index, we have still seen massive growth in property prices in recent times. For example, it was only towards the end of the 1980s that the average property price in the UK moved above £50,000. Just over 30 years later and prices are now above £250,000.

If you're a baby boomer, you have likely seen exponential growth in the value of your home. However, as your children fly the nest, you might have been left with a relatively large property that is too big and costly for just two of you.

Alice from Teacake Travels told us that children leaving home is an ideal opportunity to rediscover what you love. She said: "Now that your children how flown the nest, this is the perfect time to remember and reignite what your passions truly are.

"Have you always dreamt of creating and selling your paintings, having your own pottery workstation, running music workshops or teaching others how to dance?

"Seize this abundance of time and space that's been created for you. Unleash what truly fills your cup and use the room in your house to maximise your finances."

How else can you make money from your home as an empty nester?

Source: Land Registry

1. Rent out your spare bedroom

The most obvious way to maximise income from your home is to rent out one or more of your spare rooms. However, there are some concerns when dealing directly with predominantly unknown members of the public. The following issues are very often at the forefront of a home owner's mind:

- Security

- Rental payments

- Damage

- Ejecting bad tenants

These concerns have created a new business sector with websites such as SpareRoom.co.uk at the forefront of advice and safe advertising. For example, did you know that the rent a room scheme, promoted by the UK government, allows you to earn up to £7,500 per year tax-free? While the accommodation must be furnished, this is a great way to increase your income.

Where possible, it would be useful to work with local companies, seeking accommodation for their employees, as a means of mitigating any security issues. After all, an employee would not wish to rock the boat with their employer by causing problems with those providing accommodation.

2. Rent rooms to holidaymakers

Since its inception, Airbnb has attracted more than its fair share of negative headlines while opening up a whole new business opportunity for empty nesters. These negative headlines have prompted a sea change in how the company is run, focusing more on safety. Airbnb is just one of many companies now operating in this area, offering potentially lucrative opportunities for those seeking to rent out empty rooms to holidaymakers.

The amount of commission Airbnb pays you will depend upon the quality of your property, location and popularity. For example, at the moment, the company is looking for homes in Edinburgh which can accommodate four guests. This indicates the company is looking for an empty property, but you could earn up to £1686 per month.

More and more people are now looking towards this type of property deal, retaining their homeownership while creating a significant monthly income. This would allow you to rent a smaller property (or even take a holiday) and likely still leave surplus cash to cover your living expenses. While this level of income may create tax liabilities, it is worth noting that for a couple, each person is allowed to earn £12,570 per annum without incurring any income tax. Of course, this would also take in the state pension and other income, but it is still worth investigating further.

3. Storage facilities

As we so often experience, new trends that begin in the US quickly emerge in the UK. One such trend is using surplus floor space in your home as storage facilities for third parties. This may be an unused garage, ample room or even a garden shed. We know that when new trends emerge, the Internet is speedy to respond. Consequently, many websites are available today that offer advice and assistance to those looking to convert part of their home into a storage facility.

Connecting those offering storage facilities with those seeking storage facilities is fast becoming a lucrative business. When you bear in mind that the average customer is unlikely to visit the premises any more than four times a year, there would be minimal disruption to your daily life. The larger the floor space you can offer, the more income this will create. Long-term agreements, disruption-free steady income, indeed something to consider!

4. Rent out your driveway/parking space

The idea of renting out your driveway/parking spaces has been around for some time but is certainly growing in popularity. Many websites bring together those offering parking spaces and those requiring parking spaces. For example, we looked at the www.yourparkingspace.co.uk website, searching for parking facilities within walking distance of Terminal Five Heathrow Airport.

With a minimum of 12 hours parking, the hourly rate ranged from £5 an hour just 14 minutes walking distance to Heathrow airport to £4 within 29 minutes walking distance. The monthly rate ranged from £50 up to £187.50. The rate charged depends on the distance from the airport, standard of parking and above all, security. When you bear in mind these vehicles will be parked and left for hours, days or even months, there’s nothing for you to do except count the money.

You don’t necessarily need to be near an airport, either. If you live in or near a town or city centre, or a venue where parking is typically hard to come by or expensive, like a train station, sports stadium, or music venue, this could be a great opportunity.

5. Movie sets and TV adverts

Many empty nesters are now waking up to the idea of renting out their properties to movie sets and for TV adverts. While there is a general misconception that only the “best quality” properties will be in demand, this is not necessarily the case. As not all movie sets and TV adverts feature the “best quality” properties, there is, in theory, demand for any property. So how much can you make?

It would depend on the client, location and duration of their stay. Moviemakers could pay anything from £500 a day up to £2500 a day and beyond. Of course, if you were hosting a Hollywood blockbuster, you would probably expect to charge a little more. The benefits are twofold; the homeowner can create a significant additional income stream, the moviemakers save money on making new housing sets. Does this look like the perfect match?

Similarly, empty nesters are now renting out their properties for £300 upwards a day, depending on the location/quality of the property, for photoshoots. Many people are concerned about damage to their property and insurance costs. However, it is the norm for the customer to take out insurance to cover any damage. Indeed a standard contract would include a clause whereby the property has to be returned in the same condition as received.

6. Rent out your swimming pool

While private swimming pools are standard in Australia and many parts of the United States, they are not so common in the UK. However, if you are lucky enough to have a swimming pool in your private garden, this could create a very lucrative income opportunity!

Extensive gardens with swimming pools could be used for:

- Parties

- Weddings

- Christenings

- Large social events

People will pay significant money for private venues offering a large garden and swimming pool. After all, what better way to cool off during the long hot summers?

7. Office space

In recent times we have seen an enormous increase in the number of self-employed people working in the UK. The introduction of the Internet and access to funding will likely see this trend increase, with a short-term boost expected after the Covid-19 pandemic is over. While there may be short-term limitations due to the pandemic, there may be an opportunity to convert unused rooms into offices.

Due to the limited running costs of such conversions, it is possible to charge a rate that undercuts commercial small office facilities but creates a good return for the homeowner. There will be other issues to consider, such as:

- Electricity

- Heating

- Insurance

- Internet access

- Wear and tear

However, even when considering the potential costs, this still leaves more than enough net profit. For many people, the main downside would be third parties regularly working in their property. The impact of this may be reduced by creating access to office space via a separate private entrance. That way, they could come and go without bothering you.

8. Sell excess land

As the UK population continues to grow, land is now at a premium as developers look for new property locations. Many properties built in the 1960s, 1970s and even the 1980s came with significant front and rear gardens. As a result, there may be potential to sell or lease relatively large areas of land which could accommodate new housing. Even though there are various regulations you need to abide by regarding the size of land required for a new property, this is becoming more commonplace.

For those looking more long-term, there may be an opportunity to fund additional housing on excess land and place this on the rental market. Not only would this create long-term rental income but also potential long-term capital growth. But, again, as with many of these additional income ideas, there may be tax issues to consider. Therefore, if you're looking down this particular route, it is sensible to take professional financial advice at the earliest opportunity.

9. Create a haunted house!

Many of us are old enough to remember the Amityville horror house, a “terrifying tale of demonic possession”. History shows us that the house was the site of a brutal slaughter, ghostly voices, ghostly sightings and more. Much of this was found to be a hoax. Nevertheless, the story provided the basis for numerous horror books, horror movies and significant income for the property owners and their agents.

Many of the "mysterious goings-on" have already been exposed as a hoax. However, even today, there is an air of mystery and intrigue around the property. So much so that the local authorities had to change the official address to deter ghoulish sightseers!

We are not suggesting you involve your property in a ghost story, horrifying events or demonic possession, but this does illustrate an ingenious level of creativity.

Maximising income from your empty nest

We can only imagine the number of properties around the UK that are home to empty nesters after their children fly the nest. As many are connected with the "baby boomers", it is likely that mortgages will already have been repaid, and these are effectively non-income-producing assets. There are many ways in which you can supplement your income, as we have detailed above, although you will need to keep one eye on your tax liabilities. If none of these ideas appeals to you, why not consider a simple downsizing, allowing you to create a significant nest egg for the future?

Pension Times spoke to personal finance coach Tolu Frimpong, who told us: "While it may feel like a hassle or inconvenience setting up side hustles from home, the monetary benefits of picking up just one or two are huge. Let's take renting out your garden space, for example. Renting your garden for functions, campsites, or allotments can easily net you up to £100 per week. What could you do with an extra £100 per week?"