Is the UK state pension really the lowest in Europe?

You will probably have seen the state pension “comparisons” between the UK and the likes of France, Spain and Germany. These figures have been posted thousands of times on social media. However, the pension comparisons have been researched in detail by the Full Fact website. Aside from the figures being out of date, they are also misleading.

| Country | Weekly state pension |

| UK | £141 |

| France | £304 |

| Spain | £513 |

| Germany | £507 |

The main difference is that the UK state pension is a flat rate (the full new state pension is actually £175.20 per week for 2020/21). The state pensions for France, Spain and Germany are calculated very differently. They are dependent upon years of contributions and age, and these are the maximum payments, for higher earners. The figures are not the average, not the standard and certainly not a flat-rate state pension. Myth blown!

Maximise your retirement fund with our panel of pension providers. Click on your chosen provider to get started!

How can you stop the government from stealing your national insurance pension pot?

There is a common misconception that your national insurance contributions, which fund state pension payments, are ring-fenced for the future. This is simply not true. State pension payments today are funded by national insurance payments of those in employment TODAY. The national insurance fund that you have “built up” over the years has been spent well before your retirement.

This is one of the main reasons why the UK government is looking to extend the state pension age. We will all be forced to work longer, pay additional national insurance contributions, deferring our state pension entitlement until further down the line. While currently under review, the pensions triple lock is causing a massive problem for state pension funding.

National insurance contributions increase in line with wage inflation, but this has been low for some time. However, under the triple lock system, the cost of paying the state pension has increased faster than government income from national insurance contributions. This is making a tricky situation even worse, hence the ongoing state pension reforms.

Do MPs still have a final salary pension scheme?

Traditionally, as we grow older, our income will increase at least in line with inflation. Consequently, those that are lucky enough to be part of a final salary pension scheme should, in theory, be receiving their highest levels of income upon retirement. Unfortunately, final salary pension schemes for non-public sector workers are now very rare.

Do MPs still have a final salary pension scheme?

Yes. While MPs continue to vote to increase the age at which we will receive the state pension, they are members of a part taxpayer-funded pension scheme. You may be relieved to learn that this is not a final salary pension scheme, but you shouldn’t be!

MPs accumulate pension entitlements of between 1/40th and 1/50th of their salary for each year they are an MP. The actual figure will depend on whether they make additional contributions to the scheme. After joining Parliament, MPs tend to move up the ranks taking on extra committee work and ministerial posts. Towards the end of their career in Parliament, they may move to the backbenches until they formally retire.

Consequently, an ambitious and forward-thinking MP will likely see a significant spike in their earnings during their "mid-years" in Parliament. Especially if they're lucky enough to be in a safe seat and at low risk of losing their place on the gravy train! If their MP pension entitlement in retirement was based on their final salary, they could “lose out.” So, intriguingly, the pension entitlement of an MP is based upon their average salary. Not their final salary, as with traditional final salary pension schemes, which is a very subtle twist.

Smoke and mirrors, life expectancy and retirement age

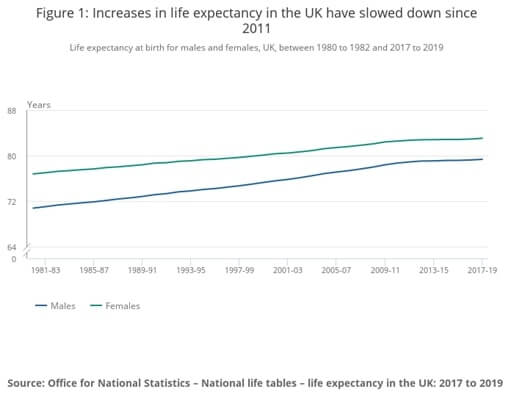

There is a consensus that life expectancy in the UK continues to increase year-on-year. This is correct to a certain extent, but there has been a significant tail off in improvements in recent years. This is demonstrated by the following graph from the Office for National Statistics.

If we take a closer look, there has been minimal change in life expectancy between 2010/12 and 2017/19:

| Period | Male life expectancy | Female life expectancy |

| 2010/12 | 78.71 | 82.57 |

| 2011/13 | 78.91 | 82.71 |

| 2012/14 | 79.07 | 82.8 |

| 2013/15 | 79.09 | 82.82 |

| 2014/16 | 79.17 | 82.86 |

| 2015/17 | 79.18 | 82.85 |

| 2016/18 | 79.25 | 82.92 |

| 2017/19 | 79.37 | 83.06 |

| Net increase over period | 0.66 years | 0.49 years |

Between 2010 and 2020, the age at which a woman could access their state pension increased from 60 years to 66 years. The equivalent for a man risen from 65 years to 66 years. As early as 2026, this could increase to 67 for both men and women, rising to 68 between 2037 and 2039. Subtly increasing the age at which you can access a state pension by a much higher rate than improvements in life expectancy: we know where this ends!

We are expected to pay a greater and greater element of national insurance and other taxes, while receiving the state pension for, on average, an ever-reducing number of years in retirement. Surely this is a win-win for the government?

As for us, we’ll just have to work until we drop, quite literally!

Why won’t the government reduce retirement age to increase youth employment?

An interesting question….surely it makes sense? Unfortunately, it is not as simple as that when it comes to the financial calculations. Yes, reducing the retirement age would reduce the older element of the workforce. In theory, this would create more employment opportunities for younger people. So why won’t the government even consider this?

Some of the factors to consider:

- Younger people tend to earn less than older, more experienced members of the workforce. Consequently, they will contribute significantly less in terms of national insurance payments, which fund current state pension payments.

- Increasing the number of people in receipt of the state pension would increase overall state pension liabilities. At the same time, this would reduce short-term national insurance income and exacerbate the existing funding gap.

- The roles that mature workers would vacate may not be suitable for younger, often less experienced individuals.

In essence, the UK government is determined to make us work longer, contribute more in tax and national insurance and reduce our years in receipt of the state pension.

Pension reforms: Smoke and mirrors

Over the last three years, we have seen significant changes in the state pension system. Dubbed "unaffordable" by politicians, there is a determination to make us work longer and pay more in overall taxation. This ensures that state pension payments today are funded by an ever-growing workforce.

Those in employment in later life will contribute more to the economy, spending their hard-earned money - not state pension payments. Those in receipt of state pension benefits will contribute to the economy, but this is a net-zero contribution to government coffers.

Don’t let the politicians pull the wool over your eyes!