The Pensions and Lifetime Savings Association (PLSA) is a trade body focused on improving income in retirement. Recent adjustments to UK pension regulations have prompted many people to review their pension plans and potential income in retirement. The PLSA recently carried out a comprehensive review of life in retirement and retirement living standards across the UK. The Retirement Living Standards report casts a useful light on the cost of living in the UK.

Maximise your retirement fund with our panel of pension providers. Click on your chosen provider to get started!

What does the Retirement Living Standards report show us?

Research by the PLSA cast a very concerning light on life in retirement. Some of the main talking points are as follows:

- 51% of people in the UK focus solely on their current needs, with little emphasis on providing for the future.

- 77% of savers have no idea how much they will need to live on in retirement.

- Only 16% of savers questioned were able to give any figure regarding the cost of living in retirement.

This is damning feedback when you consider the size of the UK pensions industry and the ageing population. There is no doubt that the report has made people sit up and listen, consider their future and the kind of lifestyle they can expect in retirement. But are people taking action?

The findings of the Retirement Living Standards report

While no two situations are exactly the same when approaching retirement, the report focused on a minimum standard of living, moderate standard of living and comfortable standard of living. The PLSA also considered the difference in living costs between single people, couples and those living in/outside of London. The headline findings regarding annual income requirements were as follows:

| Minimum Standard | Moderate Standard | Comfortable Standard | |

| Single | £10,200 | £20,200 | £33,000 |

| Living in London | £12,400 | £24,100 | £36,300 |

| Couple | £15,700 | £29,100 | £47,500 |

| Living in London | £19,800 | £33,300 | £49,300 |

| Standard of living | Covers all needs with some leftover for socialising/fun | More financially secure with a greater degree of flexibility | Enhanced financial freedom including some luxuries |

Source: Retirement Living Standards report

It is important to note that the above figures do not include mortgage costs, rent, social care costs or tax on pension income. When calculating your personal retirement income requirements, you may need to add these figures to the above guidance.

When you consider the current state pension works out at £9,109 per annum, for many people this will go a long way to covering their most basic living costs. The UK state pension is currently covered by a triple lock system which ensures an annual increase the greater of:

- Consumer Price Index (CPI)

- Annual wage growth

- 2.5%

When you consider that inflation is currently sitting at 0.6%, this means that the state pension should increase at a greater rate. It is also worth noting that the Bank of England has a long-term inflation target of 2%. Again, in theory, this should ensure that, in the longer term, the state pension increases at a faster rate than inflation.

What should you expect for each of the living standards?

It is vital for those looking at their potential retirement income to look closer at the above minimum requirements. What kind of life can you expect? What can you do to improve your income in retirement?

The following information is based upon a single individual living in retirement. As a retired couple would share many costs, the combined cost of living would be less than that for two single people.

| Expenses | Minimum Standard | Moderate Standard | Comfortable Standard |

| Home | Decorating and DIY maintenance of one room per annum | Able to afford outside help with maintenance and decorating | Kitchen and bathroom replacement every 10 to 15 years |

| Food & Drink | Weekly food expenses of £38 | Weekly food expenses of £46 | Weekly food expenses of £56 |

| Transport | No vehicle | Three-year-old vehicle with potential replacement every ten years | Two-year-old vehicle which is to be replaced every five years |

| Holiday and leisure | One full week and one weekend UK holiday each year | A long weekend in the UK plus two weeks in Europe every year | An annual European vacation lasting three weeks |

| Clothing and personal | Clothing and footwear expenditure of £460 per annum | Clothing and footwear expenditure of £750 per annum | Clothing and footwear expenditure of £1000-£1500 per annum |

| Helping others | Average cost of birthday gifts £10 | Average cost of birthday gifts £30 | Average cost of birthday gifts £50 |

Source: Retirement Living Standards report

The different living standards and the required income to fund these will be a wakeup call for many people planning for, entering, or already in retirement. Even though the state pension covers the vast majority of living expenses for a minimum standard of living, not everyone will have additional savings/pension plans.

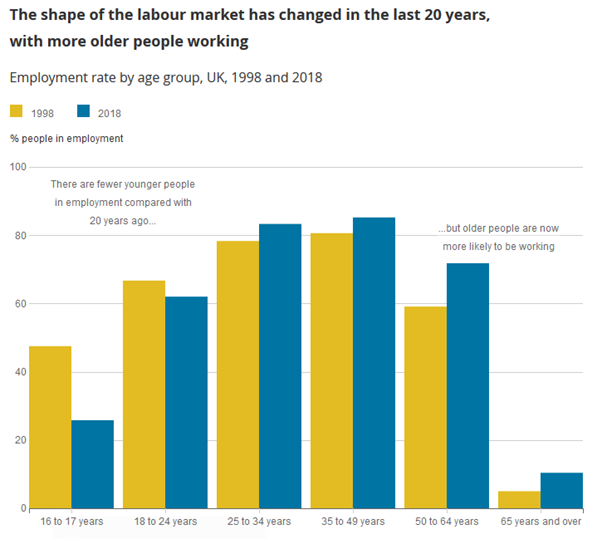

Consequently, many people are more likely to extend their working careers to fund expenses in later life. The following chart from the Office for National Statistics perfectly illustrates this:

Source: ONS

It is never too early (or late!) to plan for the future

While it is difficult to calculate the cost of living in retirement for various living standards, there is no doubt that the Retirement Living Standards report is a helpful indicator. It should give you a useful basis on which to calculate your current and future living expenses. For many people, it will also be a wakeup call to revisit their long-term retirement plans, which may consist of:

Pension arrangements

Personal pensions and workplace pensions, as well as the state pension, will have a significant impact on your standard of living in retirement. It is essential to review your pension arrangements regularly to see what kind of income you can expect. Where applicable, it may be sensible to increase your contributions.

Savings plans

As the cost of living in the UK continues to grow, with wage inflation often lagging, many people are not able to put savings to one side for the future. However, where you can see potential cost savings in the short-term, it may be useful to put these funds aside for your living expenses in retirement. There are numerous tax-efficient savings plans such as Individual Savings Accounts (ISAs) which can help create a nest egg for the future.

Equity in your home

Many homeowners approaching retirement will find themselves mortgage free with significant equity tied up in their home. While traditional mortgages, including affordability calculations, may be out of reach, there are other alternatives. Lifetime mortgages and home reversion schemes offer a way to release capital while remaining in the property rent-free. It is essential to take professional financial advice when looking to release equity in your home.

Long-term planning for your retirement

The Retirement Living Standards report gives a fascinating insight into the cost of living in retirement. While no two scenarios are the same, the report should prompt thoughts of planning for the future. It is, of course, important to focus on your current living expenses, but the sooner you start putting funds aside for your later years, the more chance of enjoying that dream retirement.