It is no understatement to say that the banking sector before us today bears no resemblance to that in the 1980s. The days when you knew your bank manager personally have unfortunately long gone. Nowadays, when perusing the internet, you will undoubtedly come across the term "grey pound," a marketing term for the purchasing power of older consumers. As growing numbers of people in retirement begin to embrace e-commerce, there are many options available with banking and day-to-day finance.

The changing world of UK banking

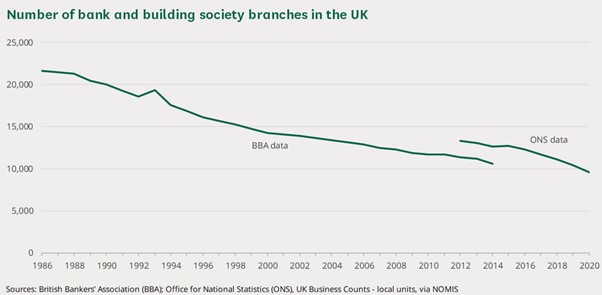

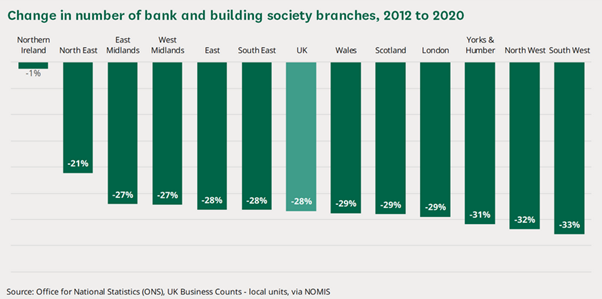

The following two graphs, from the UK Parliament website, will give you an idea of the considerable change in the UK banking system over the last decade. As the number of bank branches closing continues to rise and Post Office numbers dwindle, we all need to embrace different forms of banking.

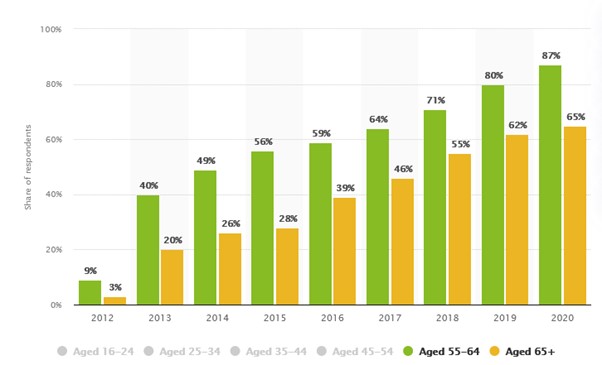

This changing dynamic has prompted an upsurge in electronic banking and, to a lesser extent, telephone banking. The following graph from the Statista website illustrates the growth in smartphone use in the age groups 55 to 64 and 65+.

Smartphone use by age

The use of banking apps is growing in popularity across a broad age range in the UK. While a valuable means of "banking on the move", not everybody has bought into the security aspect.

Protecting an elderly parent's finances

The switch to electronic and telephone banking has not been to the liking of everybody. While there are still some bank and building society branches, unfortunately, they are few and far between. Consequently, it is essential to consider all aspects when looking at protecting an elderly parent's finances.

Banking apps

All of the major banking companies in the UK have smartphone apps. There are various degrees of security, monitoring of devices used and alerts to even vaguely suspicious use. If your parents are comfortable using banking apps, it may be worth having a conversation regarding the following topics.

Login details

Unfortunately, scammers are becoming ever more inventive when contacting third parties of all ages. In recent times we have seen a growing trend towards scammers targeting those nearing or in retirement. They pretend to be from your bank, the police, or they may email or message you impersonating a family member. Never give out your login details!

Passwords

On the one hand, we are told not to keep a record of passwords, while on the other, we can't use common variations of our name, family, or date of birth. There is also the issue of using the same usernames and passwords for different services. It may be that you can keep a note of your parent’s banking app usernames and passwords in case they ever needed to check?

Always log out after use

Even though most banking apps will log you out after a period of "non-activity", it is essential to log out when you have finished. If, for example, you were to remain logged in for an additional five minutes after completing your bank transfers, what if your phone was stolen? Even though there are further protections when looking to transfer money/set up direct debits, it is essential to be careful.

Updates

Most smartphones banking apps are automatically updated, but some may require authorisation. All banking apps must be up-to-date as changes tend to focus on new services and additional security features.

Online banking services

As we touched on above, the considerable growth in the so-called "grey pound" has seen many of those approaching or in retirement more accepting of online services. Whether by choice or due to branch closures, online banking is now the more convenient option for many people. Whether managing finances for your parents or they manage themselves online, it is crucial to be aware of:

Online scams

While many see banking apps and online banking as the same, there are several differences. Emails purporting to be from online banking providers can be part of wide-ranging and potentially lucrative scams. If you receive a suspicious email from your bank asking you to click on a particular link or divulge your username/password, don't do it!

To put your mind at rest, the best thing to do is to use the Internet to search for the customer services helpline for your bank. Then, explain what has happened, your concerns and whether indeed they have tried to contact you. They will advise of any action to be taken, but you should be safe if you don’t click on any email links.

Text message scams

It seems that nothing is private these days. Many online fraudsters will use the text messaging service to contact you. Very often, the text message looks legitimate, sounds legitimate and has all the little extras such as bank name and address that you would expect. However, it is unlikely that the scammers will have your personal details and are likely to address you in a more general manner, such as Mr or Mrs. That should start alarm bells ringing!

Your bank would never contact you by text message (or even messenger) requesting you to call a number, divulge login details or click on any link. So, again, if you have any queries, you should contact your bank directly.

Simple money management tips

Thankfully, we can now move towards some of the more positive aspects of online banking. Perhaps a more appropriate term would be online money management, which includes everything from day-to-day bills to insurance, current accounts to savings accounts and more.

Savings rates

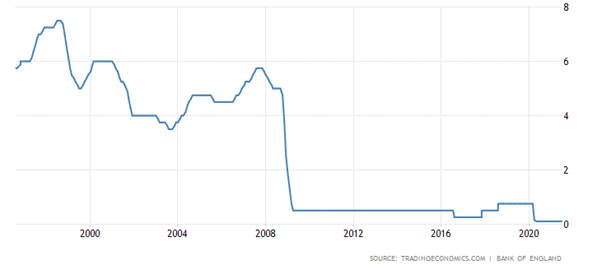

As people move towards retirement, we tend to look towards safer investments such as savings/deposit accounts. Historically, when interest rates were 3%, 4% or higher, this was a practical solution, a way in which to maintain value with minimal risk. However, since the financial crisis of 2010, UK base rates have remained at historic lows.

UK base rates over last 25 years

As saving account rates mirror the trend in base rates, it will be no surprise to learn that some savings accounts offer minimal interest at the moment. However, when you consider the current inflation rate of 2.5%, money in savings accounts is losing value in real terms.

Therefore, it may be sensible to consider fixed-rate accounts where funds are locked in for anywhere between one and five years. The interest paid will be significantly greater than an instant access account. In addition, there will likely be a financial penalty if you require access to your funds before the fixed period is over. This might involve repayment of part interest or an administration fee. However, it is worth considering as a means of protecting the spending power of your savings compared to inflation.

Manage your utility bills

Historically, many of us were pretty happy to stay with the same utility company for years. Indeed, until the 1980s and the privatisation of companies such as British Gas, there were very few, if any, options. However, the situation is very different today!

Whether managing your utility bills in later life or looking to manage your parent's affairs, there are often some desirable online deals. Unfortunately, your electric, gas, or even telecoms provider is unlikely to move you onto the cheaper deals unless you ask the question. Therefore, it is sensible to set up your utility services online and regularly check for offers with your existing provider and others.

A growing number of utility companies now offer specific services targeted towards older customers. This may accommodate different usage patterns, budgets or even allow various services to be packaged together. It is certainly worth checking out!

Insurance services

Many of us are still under the misconception that insurance companies "have us over a barrel" regarding renewals. However, the situation has changed dramatically in recent years!

A growing number of comparison websites will allow you to carry out preliminary checks on competitive car, home and even health insurance. While you will need to check the fine print before signing up, this can usually be a helpful tool to negotiate a better deal with your current provider. Where you have, for example, car, house and healthcare insurance, you may be able to bulk these together with one provider at a significant discount.

Pensions

Over the last decade, we have seen significant changes to UK pension regulations. Consequently, there is now a greater array of options as we approach retirement. While the UK government is currently putting together a centralised pension service, the Pensions Dashboard Programme, this is an area in which your parents may require specialist advice. Some of the issues to consider include:

- Structure of pension payments

- Tax considerations

- Pension deferral

- Long-term investment

- Inheritance tax considerations

Even though the long-term benefits of recent pension regulatory changes have been welcomed, more people may now need advice to ensure they make the right decision for their situation.

Managing financial affairs for someone else

Some people will face the heart-breaking reality of assisting their elderly parents as they get older and develop certain medical conditions. Alzheimer's and Parkinson's are just two of the medical challenges many people face in later life. As a consequence, it may be sensible to look at appointing someone (you?) to manage their financial affairs. It is important to note; the account holder must be of sound mind when selecting someone to act on their behalf.

There are numerous different methods to do this.

Informal appointment of third party

Many companies will accept verbal or written instructions if an account holder wishes to appoint a third party to help manage their affairs. Going forward, there may be restrictions on the actions you can take, or you might have carte blanche powers. Always check the agreement!

Ordinary Power of Attorney

This is a legally binding agreement that allows you to assist your parents for a specified period. For example, they may have an illness that requires treatment and might not be available for some time.

Lasting Power of Attorney

As the term suggests, this is a legally binding agreement that will allow you to act on behalf of your parents until instructed otherwise. Thus, even if they were to lose their mental capacity in the future, this agreement would still be binding.

The new world of online banking

For those old enough, the days when you considered your bank manager a friend have long gone. These were the days when banks saw individuals as people as opposed to numbers. The continuous closure of bank/building society branches has not helped, nor has the online revolution. However, there is no going back, and we all need to adapt and manage our finances in this very different world.

So, whether you're looking to assist your parents or manage their banking/finance interests, there are numerous issues to consider. Security is fundamental. Finding the best deals and protecting the relative value of your parent’s money will impact their standards of living in retirement. Even though many people underestimate the power of the “grey pound” and the ability of those in retirement to appreciate and utilise e-commerce fully, we all need help from time to time.