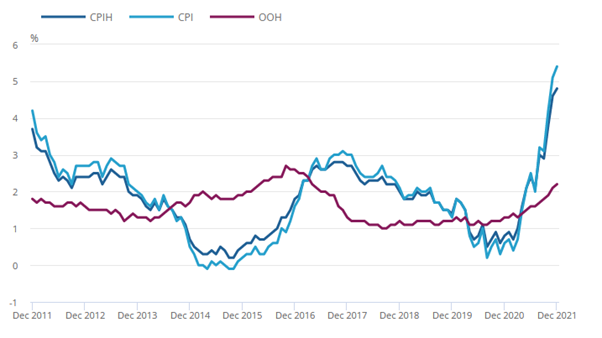

The following graph gives you an idea of how inflation, measured by the CPI and CPIH, has increased since December 2011. To clarify, the CPI does not include owner-occupied housing costs whereby the CPIH does. The graph below also shows the Owner Occupier Housing (OOH) rate to give you an idea of the costs associated with owning, maintaining, and living in your own home.

Source: ONS

The Bank of England Monetary Policy Committee met in early February to give some further background. The regular review of inflation shows it is expected to hit 6% in February/March 2022 before peaking at 7.25% in April. So, what does soaring inflation mean for your pension?

Maximise your retirement fund with our panel of pension providers. Click on your chosen provider to get started!

How does inflation impact your pension?

There are several issues to consider concerning the relationship between inflation and your pension.

State pension

In 2010, the UK government introduced what is known as the triple-lock in relation to state pension annual increases. This was introduced as a means of maintaining the purchasing power of the state pension going forward. Consequently, the state pension will currently increase by the higher of the following measures:

- Average earnings

- Prices, measured by the CPI

- 2.5%

Under normal circumstances, the state pension increase from April 2022 would have been based on the triple-lock figures for the 12 months to September 2021. However, as people came off furlough and returned to work, average earnings inflation soared to 8.3% (ONS report). The increase in wages was deemed to be "artificial" by the government, and the triple-lock was suspended. It was decided that the rate of inflation would be used for the tax year 2022/23 hence a rise of just 3.1% in the state pension.

Consequently, the state pension will increase to £185.15 a week, equating to an extra £289.50 a year. This ensures that the relative spending power of the state pension remains constant. If the CPI were lower than either average earnings or 2.5%, the relative spending power of the state pension would increase.

Private pension

There are two types of private pension, defined benefit and money purchase, upon which inflation has a different impact.

Defined benefit pension scheme

Members of a defined benefit pension scheme will receive a pension based upon their years of service and final salary. Traditionally, defined benefit pensions increase in line with inflation each year. Hence, the relative spending power of this type of pension will remain intact.

Money purchase pension scheme

Members of a money purchase pension scheme are basically left to market forces when seeking to secure pension income in retirement. For example, you may decide to acquire an annuity, offering a guaranteed income until you die. On the other hand, you may wish to enter drawdown where you withdraw funds from your pension pot each month.

The impact of inflation on annuities and drawdown

As with the different pension schemes, inflation has a different impact on annuities and those looking at a drawdown pension arrangement.

Annuities

The most common annuities allow you to secure a guaranteed income at a set rate with an annual increase, often linked to inflation, for the rest of your life. Annuities typically start from a relatively low-income base in the knowledge that payments will increase in line with inflation until you die. However, many of those in retirement are attracted to a higher initial annuity income base without the guaranteed annual inflation increase. This is because they would lose out in real terms if inflation remained stubbornly high for a prolonged period but potentially benefit if it remained low.

Drawdown

As there is no fixed annual increase with a pension drawdown arrangement, you would have to increase your pension fund investments in line with inflation to maintain relative spending power. With inflation expected to peak at 7.25% in 2022, most money purchase pension schemes will see a relative reduction in their purchasing power.

Spending habits

The report by the ONS recently cast a fascinating light on the spending habits of non-retired and retired households. You may be surprised to learn that pensioner inflation was the same as for non-retired households. However, the make-up of expenditure is different.

Many retired households have been significantly impacted by the rising cost of energy, with non-retired households more affected by the increasing price of petrol. While often leading very different lifestyles, the inflationary pressures remained the same. Unfortunately, while those in employment can still offset some of the impact of inflation by annual wage rises, there is less scope for movement for those receiving pension income.

Addressing the challenges of inflation in retirement

Inflation in moderation keeps the UK economy growing, fuels wage rises and increases consumer spending. However, high inflation will increase the cost of materials, reducing company profits, prompting cost savings and potential job losses. So, how can pensioners address the challenges of inflation?

Savings

When savings rates are low compared to inflation, this will reduce the relative value of your pension assets held on deposit. Therefore, it is advisable to spread your pension fund investments across a wide range of asset classes.

Pension fund withdrawals

If you have a money purchase scheme, perhaps a self-managed or third party managed pension, withdrawing the yield generated on an annual basis will maintain your central pension pot. Unfortunately, the annual yield generated is not guaranteed, and in some years, you may incur a loss. The degree of uncertainty will make planning challenging to say the least.

Annuities

Once you have invested in an annuity, you are locked in for the duration, usually the rest of your life. However, you can invest in time-defined annuities that may benefit from changes in interest rates and inflation in the future. Staggering investment in annuities, investing an element of your fund in the short to medium term, ensures that you are not locked into what may become an unfavourable rate compared to changes in the future.

The dangers of inflation and your pension fund

High inflation, caused by increasing demand for goods and services, can cause economies to overheat and then eventually crash, prompting a recession. We have looked at the impact of inflation on specific areas of the pension industry. However, it is also essential to consider the impact on the broader economy. Consequently, it would be best if you took professional financial advice as you approach retirement so that you can find the best solution for your needs and your situation.