For most of us, tax is one of those things that we must pay. It comes straight out of our salary each month and, despite making use of some pension savings, we have little we can do to reduce our tax bill. Annoyingly, tax eats away materially at our ability to save as it can add up to a fair wedge each month - regardless of your tax bracket.

The result? Our wealth cannot grow as it could do otherwise. The majority of us have to rely on our salary to get us through the month. Having more money saved in bank accounts and other assets would provide us with better financial freedom. Such assets would improve our financial health and wealth no end.

However, many wealthy Americans do not pay much tax at all. If the ultra-wealthy paid more, it would drastically bolster the public coffers—especially given the amount spent in the wake of the pandemic. Yet, the ultra-wealthy consistently manage to avoid legally paying tax. Here, we look at who they are and how they manage to do so to a staggering, and often eye-watering, amount based on ProPublica’s latest report.

Famous US billionaires and their tax bills

ProPublica has calculated the wealth and income taxes of the ultra-wealthy in the US from 2014 to 2018. Here, we look at four of the most famous names on that report and what their true effective tax rate was in those years.

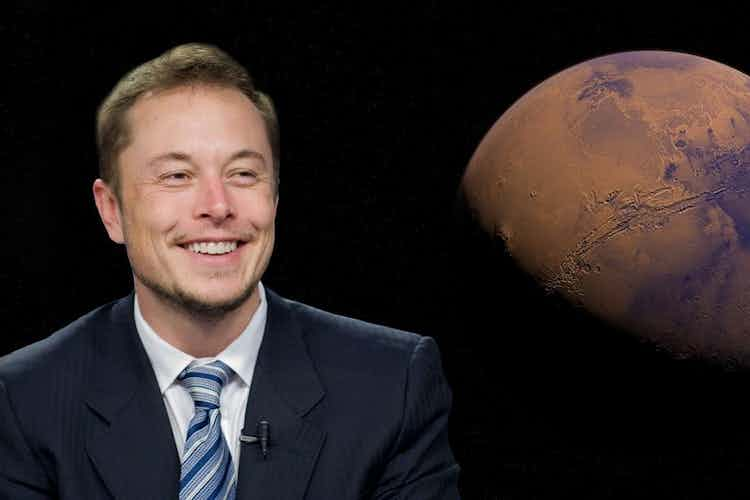

Elon Musk

Elon Musk is the controversial head of Tesla - the electric car company. Elon Musk’s wealth grew by $13.9billion between 2014 to 2018. Yet, his total reported income was $1.52billion across that period. Musk paid $455million in taxes, which equates to him paying just a 3.27% true tax rate in those four years.

Warren Buffett

Warren Buffett's tax bill is staggeringly low for a man believed to be the 6th richest person on the planet. His wealth is believed to have increased by $24.3 billion between 2014 and 2018. Yet, in that time, he paid just $237million in taxes. While that sounds like more money than many of us ever dream of, it is not in comparison to his wealth. It means his true tax rate is just 0.1%. In short, Warren Buffet paid just 10 cents for every $100 he managed to add to his wealth. Another way of looking at this paltry tax bill is that in 2015, according to IRS data used by ProPublica, 14,000 US taxpayers reported a higher income than him. Yet, he is currently worth an estimated $110billion.

Jeff Bezos

Jeff Bezos started Amazon in his garage selling books. Today, the website is the first port of call for much of the global population wishing to buy anything and everything. From 2014 to 2018, his wealth grew by almost $100billion. In that time, however, his total reported income was just $4.22billion, and he paid £973million in taxes. His true tax rate for that time, therefore, was 0.98%. Outside of the period 2014 - 2018, there have been times that Bezos has not paid any federal tax at all. In 2007, when Amazon's stock price more than doubled, Bezos did not pay tax, yet his wealth increased by $3.8 billion.

Michael Bloomberg

Michael Bloomberg's company Bloomberg LP has helped him to become one of the wealthiest Americans. From 2014 to 2018, he saw his fortune grow by $22.5billion, but with a total income reported at $10billion, he only paid $292million in taxes. That means his tax rate was just 1.3%. He benefitted particularly during the years of the Trump Administration that made substantial tax cuts. He also gave away $968.3million in charitable donations in that time and also paid foreign taxes - for which he actually received credits.

What are the current income tax rules?

These men and other ultra-wealthy Americans can have such low effective tax rates thanks to the current income tax rules in the States. Like many other countries, the USA taxes only income. Depending on that income, you pay a certain amount of tax. It is structured so that the more you earn, the more tax you should pay. The rationale being that you can still lead a comfortable life by not receiving a more significant proportion of your salary when you earn over specific amounts. Presently, if you are in the highest bracket, your income is taxed at 37%.

Plus, the country does see tax receipts from corporate taxes. Given that so much of the top 25 Americans' wealth is tied up in their business, some say that corporate taxes are a way that their wealth is taxed. Yet, many US companies do not pay US corporate tax. They report their earnings abroad to reduce their tax bill. Apple, for example, books a lot of its revenues in Ireland, where the corporate tax rate is just 12.5%.

How do US billionaires reduce their taxes?

Bearing in mind the income tax structure, how do billionaires reduce their taxes to only pay low single-digit tax rates? Remember that the highest tax rate is meant to be 37%. They use several clever tax avoidance tactics. Tax avoidance is not illegal, though ProPublica's report does allude to the fact that some of these billionaires may partake in illicit dealings. Legal tax avoidance, however, is legitimate and above board. Here’s how it’s done:

Report a low income

CEOs like Musk and Bezos famously only take a paltry salary from their multinational companies. There are so many famous examples of this. Bezos, for instance, earns an $80,000 wage a year. Facebook's Mark Zuckerberg makes only $1, and Larry Ellison of Oracle and Larry Page of Google the same.

While that sounds like a very noble act, it works in their favour, reducing their income that comes in a form that the IRS tax highly. Instead, they make a lot of their income from dividend recipients and through the sale of stock, which both enjoy a lower tax rate than wages.

Additionally, they may have bonds and other investments which also enjoy a lower tax rate. Plus, simply holding a lot of stock helps increase their wealth. The average American, in comparison, has to increase their wealth by saving from their taxed income. ProPublica’s report states that the entire wealth held by US billionaires is $4.25trillion. Yet $2.7trillion of that is unrealised. When it is unrealised, it cannot be taxed. Plus, many CEO's, like Buffett, do not even pay out dividends from their companies. Instead, they pile profits back into the business to help it grow - thus increasing their wealth further.

Borrow

Billionaires can also make the most of their wealth by borrowing money on which to live. And, given the level of their wealth, they can borrow a considerable amount of it. And that borrowing is far cheaper than paying taxes. Interest rates are at historic lows. Income tax, in comparison, sits at 37% for the highest wage earners, and capital gains tax is 20%.

Borrowing also provides another benefit. In addition to reporting a low income compared to their overall wealth, the ultra-wealthy look to reduce their taxable income even further. They do so by offsetting it against losses made elsewhere in their tax statements. Borrowing allows them just one means to do that as the interest on loans is tax-deductible. Many can even claim that they are making tax losses on their income.

What can be done to reduce wealth inequality?

Given the jaw-dropping amounts of wealth these billionaires have and the low comparative effective tax rate they pay, some want drastic tax reform. The pandemic has exacerbated this ill-feeling, given that many of the ultra-wealthy saw their wealth increase exponentially. This against a background of many Americans experiencing a reduction in income or losing their jobs entirely.

Back in 2011, Barack Obama did try to address the inequality in the amount of taxes people pay as a percentage of their income and wealth. He proposed something called the Buffett Rule to raise income tax rates on those who reported earnings of over $1million. In theory, that sounds great. But it didn’t pass, nor would it stop how many ultra-wealthy shield their wealth from tax payments. Given that it was based on income, and many billionaires say they do not have an income, reduced tax payments would still occur.

President Biden is now also seeking to address this issue. He has proposed a raft of new tax rules to help improve the country's tax receipts. For starters, he has suggested increasing the top income tax rate from 37% to 39.6%. If passed, that will hit those making over $400,000 a year. They are also proposing increasing both the corporate tax rate and the IRS's budget to help bring in yet more tax income for the US.

However, some of his party do not think these ideas go far enough. Sen Ron Wyden, the senator for Oregon, has suggested taxing unrealised capital gains. Senators Elizabeth Warren and Bernie Sanders have also proposed other wealth taxes. The problem with either of these is that it makes valuing assets tricky. It also makes it harder to get to an endpoint of fair tax paid by all. By making these rules, people will start coming up with other tax avoidance methods. Even Biden's less innovative proposals would not affect the amount of tax the ultra-wealthy pay.

Are the current US tax laws fair?

When you put these figures on paper, it seems easy to conclude that current US tax laws are not fair. However, despite proposals to help increase tax receipts from the ultra-wealthy, it seems that there is not a great deal that can be done in practice. The ultra-wealthy are wealthy enough that they can pay clever tax accountants to avoid tax legally. They will simply do so again if the rules change.

Many of the ultra-wealthy also argue they give a lot to charity. They assert that they prefer giving their wealth away in this method as they believe it to be more effective. However, ProPublica's report highlights the vast inequalities between the ultra-wealthy and ordinary American wage earners. By the end of 2018, the wealthiest 25 Americans were worth a combined $1.1trillion. It would take, in comparison, 14.3million ordinary American wage earners to amass that debt together. Yet, the federal tax bill in 2018 was $1.9billion for the top 25. The bill for all the wage earners was $143billion. When figures are that large, they are hard to comprehend fully. But they are at least stark and demonstrate how far inequality has gone.

Finally, it's worth remembering we do all pay tax for a reason. Many of us do enjoy the benefits of it without often realising it. Public infrastructure is something we often take for granted. Arguably, governments could improve public infrastructure with more efficient spending of public money, but that infrastructure is still there. Surely, we should all pay fairly to help support the society we all live in?

Image Credit: Tumisu at Pixabay