Whether looking at retirement apartments, retirement housing or traditional properties, it is vital to be aware of your rights and access to finance. Historically, access to mortgages after 50 was relatively sparse and uncompetitive. However, this sector and life expectancy have recently seen some dramatic changes. While many approaching retirement age have benefited from a buoyant UK property market, extended careers have also increased income and net wealth.

We will now look at the two main types of retirement property, traditional homes and specialist retirement developments.

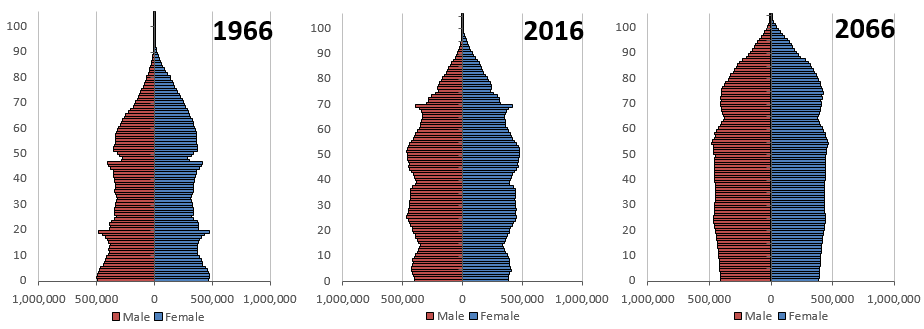

The UK has an ageing population

Before we look at the subject of retirement homes and properties, it is crucial to be aware of the changing shape of the UK population. The below graphs illustrate the growing number of older people living well beyond traditional retirement dates in 1966 and 2016 and projections for 2066. Consequently, it is easy to see why there has been a considerable increase in the number of properties purchased by those in retirement and new build retirement housing in specialist complexes.

Source: ONS

What is retirement property?

In simple terms, retirement property is housing made available to those of a certain age, typically over 55. This type of retirement development can offer various properties, from flats to bungalows to traditional properties, offering varying levels of independence. You will often hear retirement developments called "retirement villages", suggesting a retirement community. There are several specialist retirement development companies in the UK, including McCarthy & Stone, seen by many as the leader, and Churchill Retirement Living. However, nothing is stopping you from finding a home with a traditional high street estate agent, either!

Leasehold properties

Most retirement properties in the UK are sold on a leasehold basis. The lease can be anywhere from 99 to 999 years in duration. Whether buying a new property or an existing home, it is essential to know the costs associated with leasehold properties.

Service charge

Under the terms of a leasehold property, you may be asked to pay a service charge – this is more relevant for retirement developments. It is legitimate for the freeholder to charge the leaseholder for an array of issues such as:

- Cleaning of communal areas

- Heating the building

- Additional staff

- Management company fees

- Maintenance and repairs

- Building insurance

Service charges ensure that all those in a particular development pay their fair share towards the upkeep of the building(s). It is important to note that the building insurance element only covers the freehold building containing the leasehold property. Consequently, this does not include contents insurance for your personal belongings.

Ground rent

The subject of ground rent has been a hot topic of late as it can increase by a significant amount over time. This payment is what you would expect, a rent to the freeholder that owns the land on which the leasehold property is built. Knowing the ground rent terms, which can begin at relatively low levels with some increasing (often doubling) every ten years or less, is essential. This may seem irrelevant, but even a modest £100 ground rent valuation that doubles every ten years would increase to £3,200 annually after 50 years.

This financial liability would pass to those who inherit your retirement home.

Rising charges

This ongoing increase in ground rent (covered in the leasehold agreement) can be a challenging hurdle when looking to sell a property in the future. We also have the issue of rising service charges, which can increase significantly over time. There have been occasions where retirement properties left to beneficiaries on the owners' death have proved difficult, if not impossible, to sell, often resulting in an expensive financial liability. You must take advice on the leasehold agreement!

Amending a leasehold agreement

Many looking to acquire retirement homes within retirement developments will have previously held property under freehold ownership. This is very different from leasehold ownership, where the freeholder retains control over what you can do with your property. There is also the issue of the lease duration which will decrease annually. Thankfully, protection for leaseholders has changed dramatically in recent years, and they now have a legal right to extend the lease term.

The remaining duration of the lease can significantly impact the resale value, and you must take legal advice to protect your investment. For example, a leasehold property with a 99-year lease would be more valuable than the same property with a 69-year lease. There is a procedure to go through when extending the lease with costs incurred by the leaseholder.

Retirement scheme management

Most retirement housing developments will incorporate several communal services and areas. Even though these developments are built around the concept of independent living, the management company will often appoint a third-party scheme manager or warden service. While it will differ from development to development, scheme management could take in any of the following services:

- Emergency help or extra care

- Emotional support for residents

- Administrative duties

- Housing management

- On-site events

- Out of hours cover

- Advice and guidance on benefits and social care

Those retirement schemes which do not have a scheme manager will have lower service charges. Still, there are obvious benefits to having additional help. Recently, we have seen the creation of various associations to protect those living in retirement housing developments. These include the Associated Retirement Community Operators (ARCO) and the Association of Retirement Housing Managers (ARHM).

ARHM code of practice

Those management organisations that are members of ARHM have a specific code of practice to which they must adhere. The broad code covers:

- Provision of services

- Setting and collecting of service charges

- Annual meeting with leaseholders

- Encourage the setup of residents' associations

Another element of the ARHM code of practice involves the "Leaseholder's Handbook", often referred to as a Purchase's Information Pack/Resident's Handbook. This handbook is available to all interested parties and, if requested, must be provided in advance of the completion of a retirement housing purchase.

The Leaseholder's Handbook is designed to give you all of the information relevant to a potential purchase but does not replace the leasehold agreement. The handbook should include:

- Name and address of the landlord and management organisation

- Services provided and the cost

- Details of the scheme manager service

- Information on reporting repairs and their completion

- Legal and contractual rights of leaseholders

- Resale procedure

- Consultation and complaints procedures

You must employ the services of a solicitor to look over and explain the leasehold agreement. For example, there may also be specific procedures or restrictions regarding the resale of leasehold property within retirement villages or retirement living developments. The handbook will explain issues such as these. You must be aware of any legally binding procedures you must follow when selling your property.

Buying a home in later life

Whether looking to downsize or acquire a family home in later life, there are still traditional options outside specialised retirement developments. For example, you may be looking at relocating your family home or acquiring a two-bedroom apartment that is more manageable and less expensive. Even though there have been developments concerning mortgage finance for older homeowners, there are still some issues to be aware of.

Mortgages for over 50s

Due to improved life expectancy and extended working lives, there have been significant positive developments in the mortgage market for over 50s. As a result, competition in this area has increased, with many attractive deals available.

Tax planning

If you're looking to acquire a new home in later life, this could be the perfect time to revisit your tax planning. Your financial requirements pre and post-retirement will be very different, and it is essential to plan as much as possible. For example, you may need to consider the potential cost of care homes going forward and how this might impact the value of your estate.

Know your options when buying retirement property

Whether looking at leasehold, freehold, retirement housing or a traditional home, you must know your options before signing any agreement. Even though we have seen positive developments regarding leasehold properties, there are still many costs and conditions you should be aware of.

While interest continues to grow in retirement villages and similar specialised developments, this type of independent living is not for everybody. This has prompted significant investment in mortgage finance for the over 50s, with many people looking at new properties and retaining their independence. Whatever your preference, it is vital that you take professional financial advice every step of the way. Even if just for your peace of mind!